Actuarial Science: What Is It?

Using mathematical and statistical techniques, actuarial science evaluates financial risks in the insurance and finance industries. The field of actuarial science uses probability and statistics mathematics to describe, examine, and resolve the financial ramifications of unknown future occurrences. The study of mortality, the creation of life tables, and the use of compound interest make up the bulk of traditional actuarial science.

Knowledge of Actuarial Science

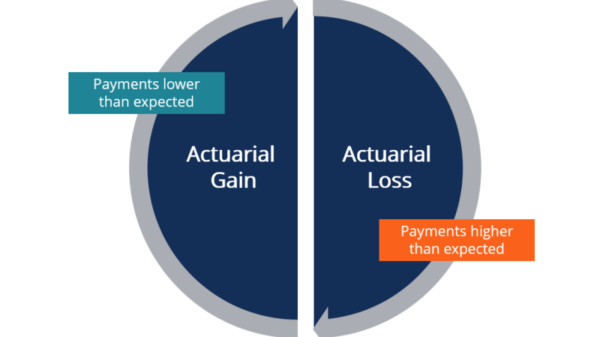

Actuarial science uses probability analysis to measure the possibility of an event happening so that its financial effect may be calculated. Actuaries often employ actuarial science in the insurance sector. Actuaries examine mathematical models to foresee or foretell whether it is reasonable for an event to occur so that an insurance provider may set aside money to cover any claims arising from the occurrence. Insurance firms, for instance, might learn more about the chance or timing of paying out a life insurance policy by researching the death rates of people of a given age.

With the rise in long-term insurance needs in the late 17th century, actuarial science was formally established as a mathematical field of study. Mathematics, probability theory, statistics, finance, economics, and computer science are all connected fields of actuarial science. In the past, actuarial science created tables and premiums using deterministic models. Due to the widespread use of high-speed computers and the fusion of stochastic actuarial models with contemporary finance theory, science has experienced dramatic transformations over the last 30 years.

The use of actuarial science

Actuarial science is mostly used in pension programs and life insurance. To examine liabilities and enhance financial decision-making, actuarial science is also used to study financial organizations. Actuaries use this specialized science to assess how future events affect the economy, finance, and other business areas.

Insurance

Actuarial science is used in conventional life insurance to create life tables, analyze mortality, and apply compound interest, combining interest from earlier periods with interest in capital investment. Actuarial science may thus aid in creating regulations for financial products like annuities and investments that provide a guaranteed income stream. The varied financial outcomes for investable assets owned by non-profit businesses as a consequence of endowments are also determined using actuarial science.

Actuarial science involves examining the use rates of health insurance, including employer-provided plans and social insurance.

The prevalence of disability or the likelihood that a certain group will develop a disability. Morbidity, or how often and widely an illness affects a population

Mortality or mortality rate, which counts the number of people who die in a population as a consequence of a certain illness or circumstance

Fertility, often known as fertility rate, counts the number of births.

For veterans who could have suffered injuries in the line of service, disability rates are calculated. To calculate the reimbursement from disability insurance, certain percentages are given to the degree of the disability.

Actuarial science is also used in cases of property, casualty, liability, and general insurance, where coverage is often offered annually or renewable. After the period, any party may terminate coverage.

Pensions

Actuarial science evaluates the costs of various approaches to the design, financing, accounting, administration, maintenance, and redesign of pension systems in the pension sector. A defined-benefit plan, or pension, is a retirement arrangement in which the employer makes payments that are put away and distributed to the participants upon retirement.

Bond rates on the short and long terms significantly impact pension plans’ investment choices. Bonds are financial obligations issued by governments and businesses and often bear an interest payment over time. For instance, a pension plan may find it difficult to generate income from the bonds purchased in an environment with low interest rates. This raises the possibility that the pension plan may eventually run out of funds.

Benefit arrangements, collective bargaining, the employer’s competitors, and changing worker demographics are other elements that might affect the profitability of a pension plan. Tax regulations and Internal Revenue Service (IRS) guidelines for calculating pension surpluses further impact a pension plan’s financial situation. Prevailing economic circumstances and financial market developments may also impact the likelihood that a pension plan will stay funded.

The government may also employ actuaries to help with proposed Medicare, Social Security modifications, or other programs.

Educational institutions and professional certifications. The Bureau of Labor Statistics projects a 21% increase in actuaries working between 2021 and 2031.

For this reason, actuarial science is a subject covered in many university academic programs. Furthermore, professional credentials are available for anyone interested in a career in the area.

Universities

Colleges that satisfy one of three levels of recognition are identified and reported by the Society of Actuaries:

- UCAP-Introduction Curriculum: A list of universities that, in addition to meeting all other authorized course criteria, maintain course requirements for two professional actuarial examinations.

- UCAP-Advanced Curriculum: Universities that uphold four professional exam course requirements and other accepted course criteria.

Universities that uphold eight specified conditions about various issues are considered Centers of Actuarial Excellence. The SOA has defined this as a university’s highest level of capability. - Around 25 Center of Actuarial Excellence schools are in the United States, Canada, Australia, Singapore, the United Kingdom, and China as of December 2022. These universities include Brigham Young, Georgia State, Purdue, Connecticut, and Michigan, among others, in the United States.

Professional Credentials and Designations

An actuary might seek various professional qualifications to increase their reputation and expertise. The Associate (ACAS) and Fellow (FCAS) membership tiers of the Casualty Actuarial Society have growing criteria. For instance, the ACAS certificate requires completing six tests, but the FCAS requires clearing nine exams. The FCAS exam’s focus areas are as follows:

- Probability

- Financial Calculus

- Monetary economics

- Actuarial Statistics of Today

- Policy Liabilities, Insurance Company Valuation, and Enterprise Risk Management Basic Techniques for Ratemaking and Estimating

- Claim Liabilities Regulation and Financial Reporting

- Modern Ratemaking

- The Society of Actuaries encourages taking various actuarial tests to prove one’s expertise.

An Associate of the Society of Actuaries (ASA) exhibits an understanding of the core theories of modeling and risk management. Beginning in Spring 2023, new examination criteria will include tests on areas including financial markets, economic theory, probability, and predictive analysis.

A Chartered Enterprise Risk Analyst (CERA) is an expert in recognizing, evaluating, and managing risk in organizations that take on risk. The CERA standards include professional training addressing the code of conduct, like the ASA requirements.

A Fellow of the Society of Actuaries (FSA) exhibits expertise in financial choices affecting investments, pensions, life insurance, and health insurance. FSAs must also exhibit an in-depth understanding of these diverse fields and the use of acceptable methods.

Actuarial science: Is it challenging?

The field of actuarial science is challenging. Actuarial examinations often run between three and five hours, each requiring extensive study. It may take a candidate up to 10 years to finish all training and tests, and candidates are sometimes required to have a bachelor’s degree.

What kind of math is used by actuaries?

A background in statistics, financial mathematics, and probability is common among actuaries. An actuary will often evaluate the likelihood of an event before using statistical techniques to calculate the financial implications of that result. Calculus is often not used by actuaries in the workplace, although it can be necessary to complete other course requirements.

What Is the Time Frame for Actuarial Training?

The average person may need up to ten years or more to become an actuary. It may take three to five years to get a bachelor’s degree in actuarial science, and it can take at least another several years to pass challenging professional actuarial tests.

Actuarial science is the study of quantitatively estimating the likelihood of an event occurring in the future and putting a monetary value on that possibility. Actuaries are trusted by businesses, pension funds, and insurance companies to create models that identify risky areas and propose strategies to reduce possible problems in the future.

Conclusion

- Using mathematical and statistical techniques, actuarial science evaluates financial risks in the insurance and finance industries.

- Actuarial science defines, examines, and resolves the financial consequences of unknown future occurrences using probability analysis and statistics.

- Insurance firms use actuarial science to anticipate the likelihood of an occurrence to calculate the amount of money required to pay claims.

- Beyond a bachelor’s degree in actuarial science, the Casualty Actuarial Society (CAS) and Society of Actuaries (SOA) encourage actuaries to obtain some professional certifications.

- According to the most current wage data from the Bureau of Labor Statistics, as of May 2021, actuaries made an average compensation of close to $106,000.

Comment Template