The Fintech industry is growing fast with the implementation of new features. These companies are employing technology in almost every activity, to be competitive in the market. They are automating their backend to offer solutions to customers.

A company with the best fintech CEO will always achieve a higher profit margin. These financial industries are innovating the best ways to serve insurance, real estate, cryptocurrency trading, and other payment management systems. Others are using AI and API technology to improve on reliability and speed of transactions. Fintech CEOs are the ones on top to initiate such changes. It takes a good leader to ensure his or her company is getting positive feedback and higher income. Here we look at the top financial industry CEOs that still promise in 2022.

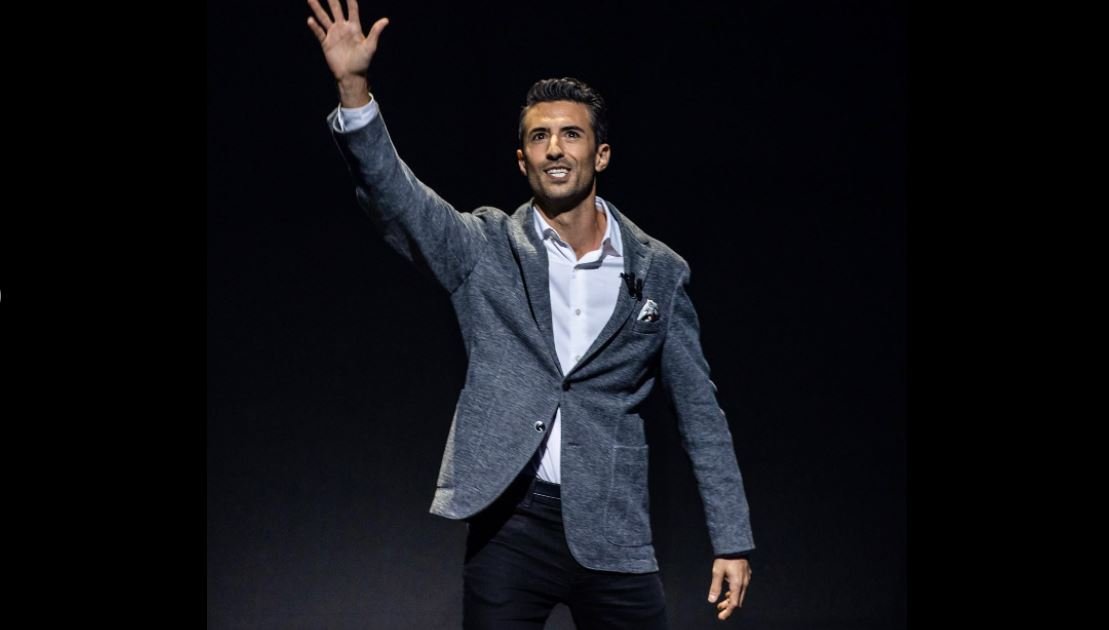

Robert Reffkin

Company: Compass

Robert achieved his degree in economics, history, and philosophy from the University of Columbia. He went ahead to study MBA. His mother was a real estate agent who inspired him to join the industry. He worked at the White-House and later joined Goldman Sachs. He founded America Needs, which holds mentorship programs for college students.

In 2012, he co-founded Compass, a real estate broker that uses smartphone technology to market its product. Agents and buyers meet and share ideas from the platforms. Through investors, the company has managed to raise $775 million to expand its roots. It was not until after the pandemic, earlier this year, that the company went public. It made huge sales and is estimated to have a revenue of $10 billion. All this has made Robert the top financial technology CEO in the world.

Simon Paris

Company: Finastra

In 2015, the young Paris made his way to Finastra as president and chairman of the board. Two years later, he rose to deputy vice president. He has experience in management, sales, and leadership for almost 20 years. At one point he worked under McKinsey Company. He is the current CEO of Finastra. He steers the whole plan and approves any innovative idea in the company. The company makes use of cloud computing and Fusion software architecture to build fintech models.

Sebastian Siemiatkowski

Company: Klarna

He is an Alumni of Stockholm School of Economics where he studied economics. He founded the service Klarna in 2005 where consumers could pay through installments when they buy online goods. People referred to him as the inventor of the popular slogan ‘Buy now, Pay Later’. Sebastian is the CEO of his Swedish fintech company. The company allows for direct payment, post-purchase payment, and online storefront payments. Klarna has offered much competition to PayPal in Sweden. The European company has a total of over 21 million users, making it a valuable private financial tech company. Its revenue is estimated to be $31 billion.

David Vélez

Company: Nubank

David launched Nubank in 2013 and serves as its CEO. The company has a user base of approximately 20 million people. Investors have contributed $820 million to the company. It was recognized as the world’s largest neobank in 2020. The fintech firm has won numerous honors for its creative capabilities. David is a graduate of Stamford University, where he earned his MBA.

Patrick Collison

Company: Stripe

He started with an Automatic Management System where he won the 41st Youngest Scientist. The company was absorbed by Live Current Media. Together with his brother, the two technologists focused on Stripe. Millionaires like Sequoia Capital, Peter Thiel, and Andreesen Horowitz managed to invest in the company. Patrick is the CEO of Stripe.

The company allows customers to pay for goods through the internet. The platform has enabled companies and customers to carry out complex financial operations. Almost 100 countries embrace stripe as a medium of sending and receiving money.

Brian Armstrong

Company: Coinbase

Brian attended Rice University to study computer science and economics. He worked as a senior software engineer with the Airbnb company. Armstrong focused on learning how cryptocurrency works. He founded Tutor.com, an online education platform. Furthermore, he was among the first people to sign on the deal of ‘The Giving Pledge’.

He founded coinbase in 2012. The company has managed to top as the leading exchange platform for cryptocurrency in the United States. You can sell and buy Ethereum and bitcoin easily. Coinbase has a total revenue of $320 billion with over 35 million users. These successes have made Armstrong appear among the top financial industry CEOs.

Kristo Käärmann

Company: Wise

Kristo was employed by Deloitte. He helped clients rectify their system architecture and information management. He is an Alumni of Tartu University where he studied mathematics and computer science. In 2011, Kaarman co-founded Wise and he is the fintech CEO. Wise is a money transfer platform. People can exchange their money on the platform at minimum rates. According to statistics, the company transfers around 4.5 billion Euros per month. This makes him one of the best fintech CEO.

Valentin Stalf

Company: N26

In 2013, the Alumni of St.Gallen University founded N26. He serves as the CEO of this mobile app bank. The customer likes the fact that N26 online banking offers free basic accounts. It has leveraged the digital world to allow users to pay a lower coin base. The financial technology company managed to raise almost $770 million for infrastructure. The company value is around $3.5 billion hence making Kristo one of the top financial technology CEOs around the world.

Kenneth Lin

Company: Credit Karma

In 2007, Kenneth founded Credit Karma. The company gives the customer the power to monitor their credits and to prepare their tax filing for free. They offer almost everything for free but make money through advertisement. The company has managed to secure almost 85 million users across the world. Through Karma, Lin founded Multilytics Marketing agency which earns revenue totaling $40 million. He is one of the top fintech CEOs in the world.

Alex Timm

Company: Root Insurance

Alex grew up with an interest in entrepreneurship. He wanted to change the way insurance works. In 2015, he cofounded Root Insurance, where he serves as the CEO. He changed the way car insurance operates. The insurance company works towards helping the consumers. The insurance rates are calculated depending on the driving ability.

Eric Wu

Company: Opendoor.com

Eric founded Opendoor in 2014. The company specializes in building the real estate industry using technology. The financial tech company supports around 85 000 users who use the company to acquire real estate. The company is estimated to generate a revenue of $4.7 billion before the pandemic.

Chris Britt

Company: Chime

Chris studied history at Tulane University. He worked at Visa as a senior product leader before moving to ComScore. Chris joined Green Dot as chief product officer and resigned two years later. He currently serves as the CEO of Chime. The mobile banking company offers free debit card services. The company managed to raise $485 million during the pandemic to expand its branches. Its value is estimated to reach $14.5 billion. All these achievements make Chris a top fintech CEO.

Zachary Perret

Company: Plaid

Plaid was launched in 2013 as a software financial services company. Many digital fintech companies have managed to integrate their platform with the Plaid system. Consumers can connect easily with their accounts. Together with his friend William Hockey, he established the company to solve fintech problems. Almost 11000 financial institutions in Europe, the US, and Canada employ the Plaid system. The company values it at $13.4 billion.

Dave Girouard

Company: Upstart

Upstart is one of the leading AI banks that offers affordable credit services. Girouard founded the platform and serves as the CEO. The company also offers loans to its bank partners. They use a machine learning algorithm before they give out loans to various institutions. They took the company public in 2020. Their revenue doubled hence making Dave one of the top fintech CEO.

Also Read:

Pedro Franceschi & Henrique Dubugras

Company: Brex

In 2017, the two Americans founded Brex. They offer flexible credit lines depending on the current situation rather than strict deadlines. They raised $57 million in 2018 to expand their branches across America. The two friends from Brazil were into video games. They came up with Pagar.me which was later absorbed. In addition, the two joined Stamford but dropped a year later to find Brex. They both share CEO duties in trending fintech companies.

Rishi Khosla

Company: OakNorth

He founded OakNorth Bank in 2015. The company uses data analytics technology and machine learning to create its Credit Intelligence Suite. The company was developed for almost 5 years with a board of 250 engineers. He also invested in Indiabulls and Paypal during the early stages. Rishi chaired Copal Partners for 12 years when he gained many financial skills. He later sold the company in 2014, to Moody’s corporation. He is an alumnus of the London School of Economics.

Jason Gardner

Company: Marqeta

Jason is the Chief Executive officer and the co-founder of Marqeta. The company offers modern cards by innovating the processor platform. Many companies have been able to employ Marqeta software on their platforms. Marqeta is helping the financial institution to build smart cards. Previously, Jason founded PropertyBridge company which was absorbed by Moneygram. He also founded another IT management company, Vertica Think. Jason has been able to stand out as one of the top fintech CEO because of his innovative ideas.

Christian Wiens

Company: GetSafe

He is one of the founders and CEO at GetSafe. The financial technology company offers help to insurance companies. They have managed to create smart bots to replace the paperwork and complexity in the insurance companies. It’s one of the fastest-growing insurtech startups in Germany. They have almost 175000 users. His contribution and impact on the company have made him one of the outstanding fintech CEOs.

Brad Garlinghouse

Company: Ripple

Brad acquired an MBA from Harvard University. He has been in the financial industry for over 22 years. Garlinghouse has served as CEO of Ripple since 2015. The company uses blockchain technology to create a frictionless experience in the fintech industry. In addition, almost 40 countries have managed to use resources from the fintech company.

Comment Template