Shares gain, while the dollar falls before inflation data. In fair trading on Monday, global equities rose ahead of U.S. inflation data this week that might shape monetary policy expectations.

The dollar fell as the deadline for Congress to address the U.S. government’s borrowing ceiling approached.

MSCI All-World index (.MIWD00000PUS) increased 0.2%.

Friday’s strong payroll data has lowered investors’ expectations for the Fed’s first rate decrease. In addition, Wednesday’s consumer pricing statistics should indicate core inflation eased somewhat.

“With the Fed having hiked by 25 basis points last week and signalled a pause, this week’s inflation report is more about how long the Fed will keep rates at 5.25% before cutting,” CityIndex analyst Matt Simpson said.

“A hot print would presumably be bullish for the U.S. dollar as traders push potential cuts further into the future.”

Money markets indicate investors expect U.S. rates to peak and fall below 4.40% this year. The dollar is near its year-low versus a basket of major currencies.

The euro surged 0.3% to $1.10495, pushing the dollar index down 0.3% to 101.05.

Sterling, up 4.5% versus the dollar this year, was up 0.3% at $1.2664, near 10-month highs, ahead of a Bank of England policy meeting later this week.

“While it is premature to get too ‘beared up’ on the dollar until a clearer peak in U.S. rates is seen, the U.S. banking sector travails that have no easy/costless solutions, continue to make for a mildly bearish medium-term story,” said Deutsche Bank’s global FX strategy head Alan Ruskin.

Unemployment rate and change in non-farm payrolls for the United States

“Certainly,,,, it imposes more growth constraints and a greater stagflationary bias than for major competing economies.”

Since the Bank of Japan is the only developed nation not to have tightened policy, the dollar has done better against the yen. The dAs a result, the dollar/yen climbed 0.1% to 134.98.

British public holidays slowed European business, although the STOXX 600 index (.STOXX) climbed 0.4%.

After Friday’s Apple (AAPL.O) earnings rise, S&P 500 futures increased 0.1% while Nasdaq futures were flat.

As markets assess regional banking stress’s influence on lending, the Federal Reserve’s loan officer survey on Monday will garner exceptional attention.

“The survey should point to further broad-based tightening in bank lending standards,” said Bruce Kasman, head of economic research at JPMorgan.

“Continued banking system stress does, of course, increase concern that a disruptive financial market event is on the horizon,” he added. “Though our analysis suggests that the impact of credit tightening against an otherwise healthy backdrop tends to be limited.”

Photo: Graphics Reuters Graphics

Bond markets recovered on Friday’s employment report. Two-year yields rose four bps to 3.9575%, while 10-year yields rose two bps to 3.462%.

On Sunday, U.S. Treasury Secretary Janet Yellen warned of a catastrophe if Congress fails to increase the debt ceiling by early June, which has caused a month-long selloff in short-term government debt.

Gold has reached historic highs above $2,000 an ounce as a U.S. rate rise halt looms. Higher interest rates reduce investor demand for gold, which yields nothing. Last week, spot gold reached $2,072, close to 2020’s all-time high.

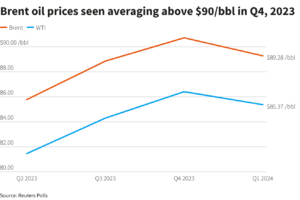

Oil climbed 2.2% to $76.97 in other commodities markets. However, as recession fears grow, Brent oil futures have fallen 10% this year.

Comment Template