After China banned sales of its memory chips to major domestic businesses, U.S.-based Micron Technology Inc. (MU.O) predicted a low- to high-single-digit revenue drop on Monday.

China’s cyberspace regulator announced late Sunday that Micron, the largest U.S. memory chipmaker, had failed its network security examination and would bar key infrastructure operators from buying from the company.

It did not specify what hazards it detected or which firm items were affected.

Analysts saw no direct impact on Micron since most of its important customers in China are consumer electronics players, but warned that political risks could cause some companies to remove Micron goods from their supply chains.

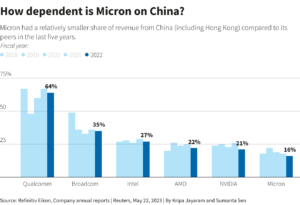

At a Monday conference, Micron Chief Financial Officer Mark Murphy said it was unclear what worries Beijing had and that direct and indirect sale to China-based companies accounted for 25% of the chipmaker’s revenue.

“We are currently estimating a range of impact in the low single-digit percentage of our company’s total revenue at the low end, and high single-digit at the high end,” Murphy added.

After plunging 6% in premarket trade, Micron’s stock was down 3.4% at $65 after the statements.

Beijing’s move, which Washington opposed, boosted Micron’s rivals in China and South Korea as mainland corporations sought memory chips from other sources.

“We firmly oppose restrictions that have no basis in fact,” a U.S. Commerce Department official said Sunday.

“This action, along with recent raids and targeting of other American firms, is inconsistent with (China’s) assertions that it is opening its markets and committed to transparent regulatory framework.”

After Chinese police raided Mintz Group and Bain, tensions between Washington and Beijing increased.

Micron is the first U.S. chipmaker targeted by Beijing after Washington placed export curbs on some American components and chipmaking facilities to prevent them from being used to boost China’s military.

China began the study in late March amid a chip technology dispute and weakening US-China relations.

The move follows the G-7’s “de-risk, not decouple” economic engagement with China and U.S. President Joe Biden’s proposal for an “open hotline” between Washington and Beijing.

The Commerce Department said it would discuss Beijing’s measures directly.

“We also will engage with key allies and partners to ensure we are closely coordinated to address distortions of the memory chip market caused by China’s actions,” the department stated.

Hu Xijin disagreed with the Chinese statement and state media that the Micron decision should be viewed as an individual instance in the context of national security considerations, not geopolitics.

“Washington itself encourages U.S. companies to do things that endanger China’s national security, so it suspects that Chinese companies are doing the same,” tweeted Global Times’ former editor-in-chief. “The whole world should be wary of the U.S.”

Michael Hart, head of the American Chamber of Commerce in Beijing, said the restriction caused uncertainty for U.S. companies in China.

Hart said, “members are asking us two things: will they be targeted because they are American, and how can they ensure they remain compliant in a business environment that appears to be increasingly influenced by national security concerns?”

Qualcomm, Intel, and Broadcom all lost approximately 1%.

Comment Template