On Monday, a government-backed fund bought semiconductor materials maker JSR Corp (4185.T) for 909.3 billion yen ($6.4 billion), bolstering Japan’s chip industry.

Japan Investment Corp. (JIC), headed by the powerful commerce ministry, is the latest in a series of increasingly aggressive government moves to recover Japan’s lead in advanced chip production and maintain its edge in materials and equipment.

In late December, JIC will tender 4,350 yen per share to take JSR private, a 35% premium over Friday’s closing price. Mizuho Bank and DBJ will finance.

Before the announcement, JSR shares soared 22%, their daily limit. Tokyo Ohka Kogyo (4186.T) jumped 10%, Sumitomo Chemical (4005.T) and Shin-Etsu Chemical (4063.T) increased 2%, and the announcement raised industry consolidation predictions.

“Capabilities here are superb, but there are a lot of us and all of us are spending money redundantly, so we feel the opportunities for efficiency gains are significant,” JSR CEO Eric Johnson told a news conference.

Johnson, a rare foreign-born Japanese corporate CEO, wanted to relist the company in five to seven years.

As President Joe Biden expands domestic chip manufacturing, the transaction comes amid rising US-China tensions. The U.S., Japan, and the Netherlands have banned chipmaking gear exports to China.

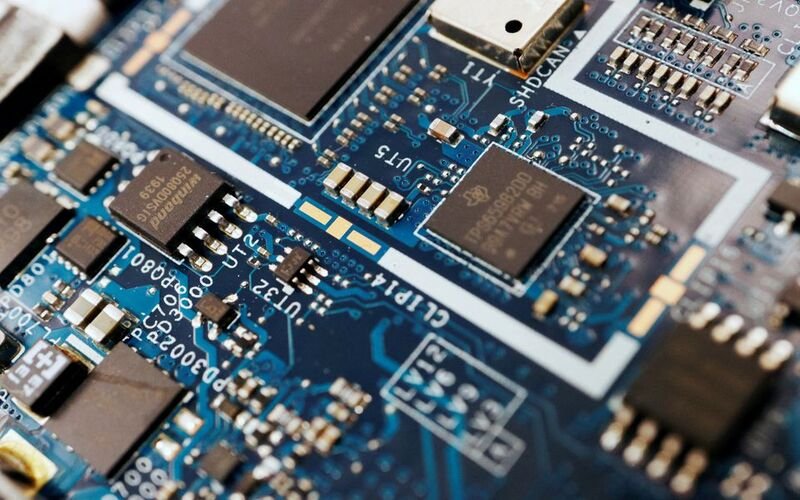

JSR is a leading photoresist supplier. “Japan has a monopoly, with China and others yet to develop this technology,” said Omdia consulting head Kazuhiro Sugiyama.

An industry ministry official said JSR asked JIC regarding backing.

The unnamed official stated JSR must invest considerably in production capacity and innovative chip fabrication materials.

Japan has a mixed record of saving struggling industrial players, but buying a profitable company that has already restructured risks overreach.

JIC increased its buyout fund by 4.5 times to 900 billion yen in November.

JIC begins. Travis Lundy of Quiddity Advisors said on Smartkarma, “It would surprise me quite a bit if that is where they stopped.”

JSR, a government-backed synthetic rubber firm founded in 1957, saw sales rise 20% to 408.9 billion yen in the year ended March, but operating profit fell 33% to 29.4 billion.

JSR’s clients include Samsung Electronics (005930. KS), Taiwan Semiconductor Manufacturing Co (2330. TW), and Micron Technology (MU.O).

Nomura stated Tokyo Ohka Kogyo is gaining market share from South Korean and Taiwanese top clients in advanced extreme ultraviolet (EUV) photoresist.

JSR shares closed Friday up 25% year-to-date. ValueAct Capital, a key shareholder and board executive, supports the deal.

Comment Template