China Evergrande Group, once a behemoth in the real estate industry, now finds itself embroiled in a tumultuous descent. This detailed examination offers insights into the factors contributing to Evergrande’s predicament, its impact on China’s property market, and the broader implications for the global economy.

The Rise of China Evergrande

1. Rapid Expansion

Evergrande’s ascent was marked by rapid expansion, focusing on residential and commercial real estate developments. The company became one of China’s largest property developers, with a presence nationwide.

2. Debt Accumulation

Evergrande accumulated substantial debt to fuel its growth, relying on pre-sales of properties and various financial instruments. This debt-fueled strategy raised concerns among analysts and regulators.

3. Diversification

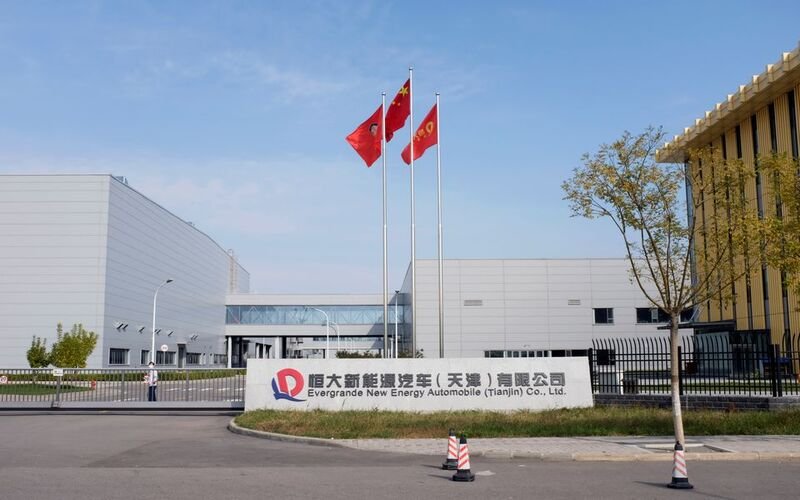

The company diversified into various sectors, including electric vehicles and healthcare, to mitigate risks associated with its core real estate business.

The Unraveling of Evergrande

1. Debt Crisis

Evergrande’s debt crisis came to the forefront as it struggled to meet its financial obligations. The company faced challenges in repaying creditors and fulfilling its commitments to homebuyers.

2. Regulatory Crackdown

Chinese authorities implemented measures to rein in the property sector, including stricter regulations on property financing and a crackdown on excessive leverage. These measures added to Evergrande’s financial woes.

3. Asset Liquidation

To address its debt obligations, the company resorted to selling assets to raise funds, including its stakes in subsidiaries and real estate projects.

Impact on China’s Property Market

1. Market Jitters

Evergrande’s troubles sent shockwaves through China’s property market, leading to concerns of a broader slowdown in the sector. Property prices, a significant component of household wealth in China, faced uncertainty.

2. Creditors and Homebuyers

The company’s struggles put creditors and homebuyers at risk. Many individuals who had invested in Evergrande projects faced uncertainty about the completion of their homes.

Broader Implications

1. Global Financial Markets

The Evergrande crisis triggered concerns in global financial markets, as international investors held the company’s debt. It raised questions about potential contagion effects on global financial stability.

2. Government Response

The Chinese government took steps to prevent a disorderly collapse of Evergrande and to protect homebuyers’ interests. These measures included facilitating debt restructuring and asset sales.

3. Real Estate Sector Reforms

The crisis accelerated discussions about reforming the real estate sector in China, emphasizing reducing systemic risk, promoting affordable housing, and ensuring long-term stability.

Conclusion

The downfall of China Evergrande serves as a cautionary tale of the risks associated with rapid expansion and excessive debt accumulation in the real estate sector. It highlights the complexities of managing a property market that plays a pivotal role in the Chinese economy. As China grapples with the aftermath of Evergrande’s troubles, the government’s response and ongoing reforms will be closely watched, not only within China but also by global financial markets and investors.