What does interpolation mean?

Based on similar known values, interpolation is a statistical method used to guess an unknown value or set of values. When investing, it is used to guess how much an investment will cost or how much it might earn. You need to use known numbers in the same order as the unknown value to interpolate.

If a trend is pretty stable across data points, it is reasonable to guess what those points are worth, even if they haven’t been calculated directly. Investors and market analysts often make a line chart with interpolated data points. An essential part of technical analysis are these charts, which help people see how the prices of stocks change over time.

Extrapolation, conversely, guesses unknown values that go beyond the known data instead of those in the middle of known data points.

How to Understand

Interpolation allows investors to make new estimated data points between known data points on a chart. It can be used on charts showing how a security’s price and amount change over time. The idea of interpolation is not new, even though these data points are usually made by computer programs these days. People have been using it since ancient times. For example, early astronomers in Mesopotamia and Asia Minor used it to fill in gaps in their views of how the planets moved.

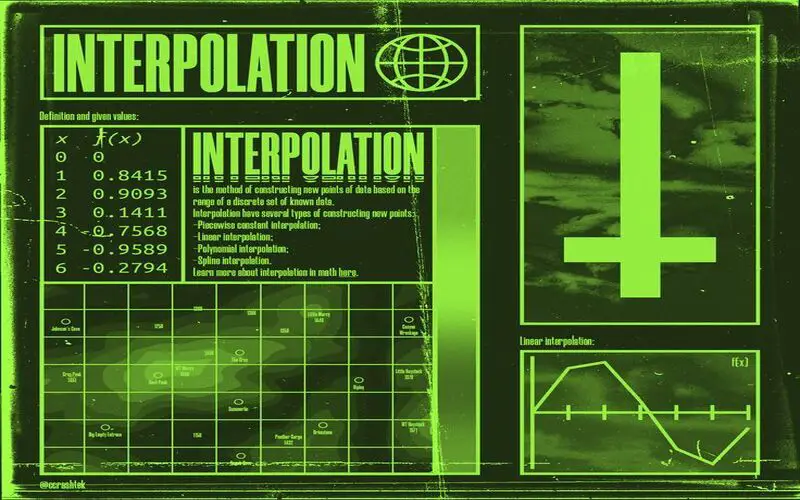

Linear interpolation, polynomial interpolation, and piecewise constant interpolation are some of the more formal types of interpolation. An interpolated yield curve is a graph that financial experts use to show the yields of new U.S. Treasury bonds or notes with a specific maturity date. Analysts use this kind of extrapolation to determine where the economy and bond markets might be going.

When you extrapolate, you guess a data point that is not in the range of data that can be seen. This is not the same thing as interpolation. When compared to it, extrapolation is more likely to give the wrong results.

A Case of Interpolation

Linear interpolation is the most common and straightforward type of interpolation. If you want to guess what an investment or interest rate will be worth without data, this type of interpolation can help.

For example, let’s say we’re keeping an eye on the price of a bond over time. f(x) will be the line’s name that keeps track of the value of the security. We would use several points to show different points in time and plot the stock’s current price over them. We could write down f(x) for August, October, and December as xAug, xOct, and xDec, which are the same in math: x1, x3, and x5.

We might want to know what the protection was worth in September, but we don’t have any information for that month. A linear interpolation method could help us guess what f(x) is worth at plot points xSep or x2 that are in the range of data we already have.

Interpolation has been criticized.

One of the main complaints about interpolation is that it’s not very accurate, even though it’s a pretty simple method that’s been used for a very long time. In ancient Greece and Babylon, it was mainly used to make astronomical predictions that helped farmers plan when to plant crops for the best results.

Even though planetary bodies move because of many things, they are better at dealing with interpolation uncertainty than publicly traded stocks, whose prices constantly change and can’t be predicted. Still, because there is so much data in securities research, enormous extrapolations of price changes are unavoidable.

A lot of the time, charts that show the past of a stock are heavily altered. Linear regression is used to make the curves that show how the price of a property changes over time. There is no way to know what a stock was worth at a certain point in time, even if there was a picture that showed its value over a year and had data points for every day of that year.

In technical analysis, what kind of interpolation is used?

In technical analysis, it can be broken down into two main types: exponential and linear interpolation. By making a straight line of best fit, linear interpolation finds the average of two data points next to each other. Instead, exponential interpolation finds the weighted average of the data points next to each other. This can be changed based on trade volume or other factors.

How is interpolation used in the stock market?

Traders may use a certain kind of interpolation, or “smoothing,” to show the spread of highs and lows between a set of closing prices. This is done by drawing a line through the highs and lows of a two-day chart, like in the picture above. In that case, the slope of the regression line shows (basically) how the prices changed over those five days. After that, this slope can be used to get a rough idea of the high-low spread’s moving average (M.A.). If prices exceed the moving average’s regression line, traders know the low range will support prices. The price drops below the moving average; however, prices will likely stay low.

Which is it: extrapolation or interpolation?

Interpolation fills in the blanks by guessing unknown numbers between two or more known data points. Instead of expanding known data points, extrapolation makes them more prominent.

Conclusion

- Investors use interpolation, a simple mathematical method, to guess the price or possible yield of an unknown security or asset by comparing it to numbers that are already known.

- Investors can guess unknown values and put them on charts that show how the price of a stock changes over time by using a consistent trend across a set of data points.

- One problem with using interpolation to study investments is that it’s inaccurate and doesn’t always show how volatile publicly traded stocks are.