What is Tangible Book Value Per Share (TBVPS)?

A company’s worth is ascertained per share using the tangible book value per share (TBVPS) approach, which measures equity without accounting for intangible assets. The absence of physical substance characterizes intangible assets, which makes valuing them more challenging than valuing tangible ones.

Price-to-tangible book value (PTBV) and TBVPS are comparable.

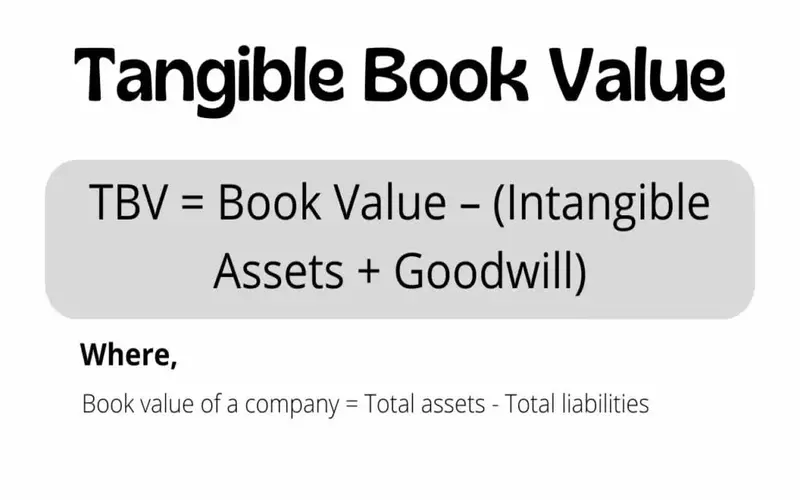

The Formula for TBVPS

Total tangible assets divided by the total number of shares equals TBVPS. Outstanding in the following areas:

Tangible book value per share, or TBVPS

Gaining Knowledge about Tangible Book Value Per Share

If a business files for bankruptcy, necessitating the sale of its assets at book value, ordinary shareholders might anticipate receiving the company’s tangible book value, or TBV. Since they cannot be liquidated during liquidation, intangible assets like goodwill are excluded from tangible book value calculations. In bankruptcy, however, businesses with sizeable tangible book values often provide stockholders with more downside protection.

As a result, tangible book value per share only considers the worth of an entity’s physical assets, including its real estate and machinery. Divide the total number of shares currently outstanding for the company by the value of the tangible assets. The sum ascertained via this method is identified as the firm’s TBVPS.

TBV offers a ballpark figure for the company’s worth if it files for bankruptcy and must liquidate every asset. TBV excludes intangible assets since certain fundamental qualities, like goodwill or staff expertise, cannot be sold for a profit. The TBV only applies to tangible goods that are simple to handle and sold for a clearly defined market value.

Potential investors may look up a company’s TBVPS over time on certain websites and online databases.

Conditions to Achieve Tangible Book Value Per Share

Any tangible goods a business manufactures and the resources needed to make them may be considered tangible assets. If a company is engaged in the production of bicycles, for example, any finished bicycles, unsold bicycle components, or raw materials used in the fabrication process would be considered tangible assets. These assets are valued according to the amount they would fetch if the business had to liquidate—most often in the case of bankruptcy.

Any equipment utilized in creating a product might be included in addition to assets connected to its manufacture. This might include any equipment or tools needed to finish the manufacturing and any real estate owned and used in the process. Additional office equipment, like computers and file cabinets, can be considered physical assets for valuation purposes.

TBVPS criticism: The ratio of outstanding shares to shareholder equity is known as book value. It solely considers the accounting value, which may not represent what would be obtained upon a sale or the current market value.

Conclusion

- A company’s tangible asset value divided by the number of outstanding shares is known as its tangible book value per share or TBVPS.

- TBVPS determines a corporation’s potential value per share if it needs to sell its assets.

- Property and equipment are examples of tangible assets. Goodwill and other intangible assets are not taken into account while calculating TBVPS.

- The imprecision in a company’s accounting of its physical assets is one of the arguments against the validity of the TBVPS.