What is a liquidator?

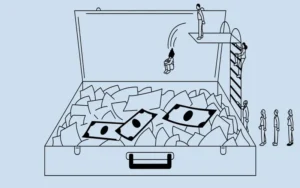

A person or organization that liquidates anything, usually assets, is known as a liquidator. Assets that are liquidated are sold for cash or other equivalents on the open market. The liquidator has the legal authority to take on several roles for the business.

An officer designated to wind up a firm’s affairs when the company is closing—usually when it is declaring bankruptcy—is known as a liquidator. A company’s liquidator sells its assets, and the proceeds are used to settle its debts. A liquidator may also be referred to as a trustee in specific legal contexts, such as a trustee in bankruptcy.

Recognizing Liquidators

A person with the legal right to sell a company’s assets before it closes to raise money for several purposes, including debt repayment, is a liquidator.

Generally, the court, unsecured creditors, or the company’s shareholders appoint liquidators. When a business fails, they are frequently hired. Upon assignment, the liquidator will assume control of the individual’s or organization’s assets. After that, they are combined and sold one at a time. The remaining debt owed to unsecured creditors is then settled using the money obtained from the sale’s proceeds.

For many liquidators, filing and defending litigation is one of their primary responsibilities. Other actions include completing other business termination procedures, paying off bills and debts, and collecting outstanding receivables.

The Liquidator’s Authority and Responsibilities

The laws in the jurisdictions where liquidators are appointed specify their authority and power. All business affairs may be turned over to the liquidator until the assets are sold and all outstanding debts are settled. Others are given privileges, but they remain under court oversight.

The corporation, the court, and the concerned creditors are all under the liquidator’s legal and fiduciary obligations. The liquidator, typically the authority regarding decisions about the firm and its assets, must maintain control over them to guarantee that they are fairly valued and distributed following a sale. This individual handles all communication and schedules meetings with the company and creditors to ensure the liquidation process runs smoothly.

How Are Paying Liquidators?

Fees for the services of liquidators vary based on the company’s size, the case’s intricacy, and the amount of time required to do the work. The absolute priority—also referred to as the liquidity preference—with which stakeholders are reimbursed in the event of bankruptcy or liquidation is outlined in the Insolvency Act of 1986.

Liquidators’ fees and expenses must always be paid first, as the law requires. Then, payments are distributed to preferred, standard, unsecured, subordinated, and senior secured creditors.

Not all liquidators are involved in the process. A self-imposed wind-up and dissolution of a business with shareholder approval is a voluntary liquidation. When the management of a firm determines there is no longer any justification for the company to be in operation, such a decision will be made. The business may choose to handle the procedure independently in certain circumstances.

Sales of Liquidations

Businesses may also hold liquidation sales to get rid of expensive goods at deeply discounted prices. Retailers frequently advertise liquidation sales, selling off most, if not all, of their inventory—often at a steep discount to customers. Don’t always do this because they’re closing down; sometimes, this can result in insolvency. To be exact, some retailers take this action to replace their outdated inventory with fresh items.

Illustrations of Liquidators

A liquidator will liquidate many stores to remove their assets due to impending insolvency. After evaluating the company and its assets, the liquidator may decide when and how to sell them. Shipments of new goods will cease, and the liquidator may arrange for sales of the existing stock. Fixtures, property estate, and other assets under the retailer’s purview will be sold. The liquidator will then arrange for the proceeds to repay the creditors’ debts.

Payless shoes are one such example. Debt-ridden retailer Payless filed for bankruptcy in 2017 and intended to close nearly all its locations in the US and Canada. Even though it was able to recover and endure that time, it was still in a precarious situation. In February 2019, the company declared bankruptcy again, announcing it would close all 2,100 retail locations in North America and stop offering customers discounts on its products.

However, liquidators are given more than just retail accounts. Other troubled enterprises might also need a liquidator. When a business buys out another, it may have to handle problems that arise following a merger. For example, one corporation’s information technology (IT) department may become obsolete during a merger. The liquidator may need to divide or sell one’s assets.

Conclusion

- A liquidator is a person or corporation that sells something—usually assets—on the open market for cash or other equivalents.

- Courts, shareholders, or unsecured creditors grant the liquidator legal authority to operate on behalf of a corporation in various capacities.

- When a firm declares bankruptcy, liquidators are usually assigned to wind up its affairs.

- Liquidators are paid first in the claim hierarchy during a liquidation.

- Smaller or voluntary liquidations, such as inventory sales, frequently do not necessitate the services of a liquidator.