What Is the Lintner Model?

An economic technique for choosing the best company dividend policy is the Lintner model. John Lintner, a former professor at Harvard Business School, proposed it in 1956. It focuses on two main ideas:

- A business’s desired payout ratio

- and how quickly existing dividends conform to the target.

Even though the model was created as a descriptive one to describe how companies are observed to issue dividends, it has since been used as a prescriptive model to suggest how companies should set dividend policies.

Knowledge of the Lintner Model

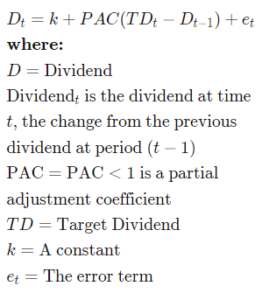

The dividend payout of a well-established company is calculated using the formula below:

Lintner Model Formula

John Lintner created this dividend model in 1956 using 28 sizable publicly traded manufacturing companies for an inductive study.

Even though Lintner passed away many years ago, his model is still the acknowledged starting point for comprehending the long-term behavior of a company’s dividends.

Lintner noted the following significant aspects of company dividend policies:

- Businesses typically base their long-term target dividends-to-earnings ratios on the number of projects with positive net present value (NPV) they can fund.

- Increases in earnings are not always sustained.

Because of this, dividend policy won’t significantly alter until managers determine the new profit levels are sustainable. Even though every company wants to increase shareholder wealth by paying out dividends continuously, natural business swings drive corporations to project their payouts based on their target payout ratio over the long term.

Based on Lintner’s method, the board of directors of a company determines dividend payments based on the company’s net income. Still, it modifies them for specific systemic shocks and progressively adapts them to changes in income over time.

The Lintner Model and Establishing Dividends for Companies

The board of directors, which also chooses the distribution date, dates, and payout rate, establishes a company’s dividend policy. Unlike in the case of a merger or acquisition, as well as other crucial matters like executive compensation, this is one instance when shareholders are not allowed to vote on a corporate decision.

The following are the three primary methods for approaching corporate dividend policy:

- The residual strategy is where dividends are paid from the remaining equity only after specific project capital criteria are satisfied. Before making any distributions, companies employing the residual dividend technique try to balance their debt-to-equity (D/E) ratios.

- The stability approach: The board frequently sets quarterly dividends at a lower percentage than annual earnings. As a result, investors have less uncertainty and a reliable source of revenue.

- A combination of stability and residual approaches, where the corporation board sees the D/E ratio as a long-term objective. In these situations, businesses typically pay out a single, easily maintainable fixed dividend, representing a tiny percentage of annual income, and an additional payout is only paid out when income is above benchmark levels.

Conclusion

- The Lintner model is an economic technique for establishing a company’s optimal dividend policy.

- The model focuses on the goal dividend payout ratio and the time required for increasing payouts to become stable.

- A company’s board of directors can readily analyze the effectiveness of its dividend policy by following the formula.