What Is Limited Power of Attorney?

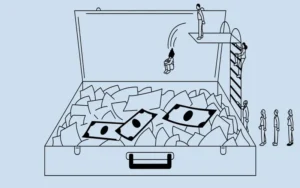

A Limited Power of Attorney (LPOA) is a document that gives a portfolio manager permission to carry out particular tasks on the account owner’s behalf. Generally speaking, the LPOA allows the manager to carry out a predetermined investment plan and handle standard account-related tasks without contacting the account holder.

Clients should be informed of their responsibilities to the portfolio manager before signing an LPOA because they are ultimately responsible for their decisions.

Comprehending Limited Power of Attorney (LPOA)

Authorizations have increased in frequency recently due to the growing trend of investors selecting registered investment advisers (RIAs) and boutique money management firms over traditional brokerage houses.

Unlike a general power of attorney, a limited power of attorney limits the chosen person’s powers to a specific domain. In this instance, the account holder has given the portfolio manager the authority to carry out the investment plan.

An LPOA grants the portfolio manager the power to purchase and sell assets, manage required paperwork, and pay fees.

Cash withdrawals and beneficiary changes are two essential account operations still limited to the account holder alone. When the account is set up, clients can expressly indicate any additional powers they may want to keep.

Types of Limited Power of Attorney

In some situations, the limited power of attorney may be used in one of the following two ways:

Energizing Forces: It becomes active when an event activates an LPOA with springing powers—typically the account owner’s death or incapacitation. It is usually used with a family living trust or a will.

Tangible and Non-Tangible: With durable limited power of attorney, the portfolio manager can carry out specific duties if the client dies or becomes incapable. Most LPOAs are not durable, meaning that in the event of the client’s death or disability, they are nullified.

Forms for Limited Powers of Attorney

A power of attorney (POA) form is usually filled out by clients when they open an account with a portfolio manager. Most forms allow customers to select between a complete power of attorney and an LPOA.

The customer has to choose an attorney, usually the portfolio manager. The form also has to include the information of any other portfolio managers who might decide on investments on the client’s behalf. The client and the attorney or attorneys must sign the form after completion.

Before signing the POA form, a client who is unsure or uneasy about the functions they approve should have it reviewed by an attorney.

Conclusion

- A limited power of attorney enables a portfolio manager to make routine choices without contacting the account owners.

- The portfolio manager can never withdraw funds or modify the account’s beneficiaries.

- The account holder may specify other exclusions to the restricted power of attorney.