What is a Limited Partnership Unit (LPU)?

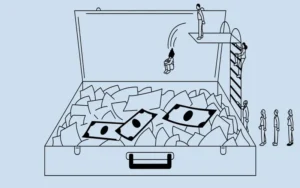

An ownership stake in a publicly listed limited partnership, also known as a master limited partnership (MLP), is a limited partnership unit, or LPU. Thanks to this trust, the unit holder has a share in the profits made by the partnership firm. A master limited partnership unit or a limited partner unit are other names for a limited partnership unit.

The Operation of a Limited Partnership Unit

In a master limited partnership (MLP), a limited partnership unit is a share certificate representing one ownership unit. A limited partnership that is openly traded on an exchange is all that an MLP is. After deducting maintenance capital, an MLP distributes all available cash from operations, including dividends, to unit holders.

Investors benefit from partnership units since the MLP avoids double taxation on the company’s cash payments, meaning that partnership unitholders often receive larger payouts. The company’s cash distributions in an MLP are only subject to unitholder taxes, not corporation taxes.

When an investor buys a stake in a limited partnership, they share pro rata profits and losses with the other owners and partners of the company. An owner or investor includes a portion of the business’s profits or losses in determining their taxable income for taxation reasons. Regardless of the actual distributions from the partnership, partners are then obliged to disclose this income or loss.

Particular Points to Remember: Obligation

Each partner’s or investor’s liability for the partnership’s debts is restricted because they can only lose their initial investment. Limited partnerships must mail an IRS Schedule K-1 to each unit holder once a year.

LP unitholders directly hold cash dividends from partnerships, but these payments are not assured. Even if the partnership does not distribute funds, each unitholder pays taxes on their proportionate revenue share.

Limited Partnership Units’ Advantages

Investing in LP units has several advantages over regular partnerships, not the least of which is the avoidance of double taxation due to the publicly traded nature of the units. These investments in limited partnership units are generally eligible to be made as IRA and RRSP contributions. LP units are primarily found in the real estate, commodities, and natural resource sectors, which include oil, natural gas, lumber, and petroleum.

Limited partners are subject to the at-risk regulations. These restrictions prohibit investors from deducting more from their limited partnership unit investments than they originally invested. The at-risk regulations restrict the limited partners’ ability to recover losses to the amount of genuine at-risk capital.

An investor is considered to have realized a capital gain, and their adjusted cost base is reset to zero if their adjusted cost base (ACB), or the amount paid for the units of their LP units, is harmful. They can decide to record a capital loss on the positive ACB and use it to offset the prior capital gain to recoup the tax paid on that amount if their ACB is positive in a subsequent year.

Conclusion

- LPUs are ownership units in a publicly traded limited partnership, also known as a master limited partnership (MLP).

- LPUs are not subject to double taxation and are classified as a flow-through entity by the IRS.

- The liability of LPUs is limited to the original investors’ capital investment.