What is a Limited Company (LC)?

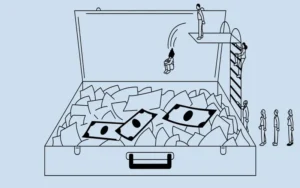

A limited company (LC) is a type of general incorporation wherein the firm’s shareholders have limited liability. It alludes to a legal framework that guarantees that subscribers’ or members’ liability is capped by the amount of money they have invested in the business or made pledges to. A limited company is a person under the law.

In the UK, the naming standard for this kind of corporate structure is to follow a company’s name with the abbreviation “Ltd.” There are various types of limited firms in the US, including limited liability corporations (LLCs).

How Limited Companies Operate

As previously mentioned, a limited company’s assets and liabilities differ from those of its shareholders. As a result, shareholders’ assets won’t be subject to seizure by creditors if the company experiences financial difficulties due to regular business operations.

Limited firms have easily transferable ownership, and many have been passed down through the generations. Membership in a limited company is governed by the company’s rules and laws, unlike in a public business where anybody can purchase shares.

There are two ways to limit a limited company: “limited by shares” and “limited by guarantee.” At least one director and one or more shareholders own a company with share restrictions. A corporation limited by guarantee is controlled by one or more guarantors and overseen by a minimum of one director.

The main advantage of a limited company is its limited liability, which allows assets and income to be kept apart from the business, owners, and investors. This implies that in the event of a firm failure, creditors or other stakeholders cannot seize the owners’ assets or income; shareholders will only lose as much as their initial investment. Investors are more willing to take on risky capital due to limited liability, which limits their potential losses.

Benefits of Limited Companies

The benefits of filing as a limited business are numerous. They consist of:

- A limited company’s directors are separate legal entities.

- A limited company structure is a barrier between the business’s owners and finances.

- It is permissible for a limited business to have assets and keep any post-tax profits.

- A limited business can sign contracts on its own.

In exchange for the privilege, limited corporations in the United Kingdom must pay various taxes, including capital gains tax, value-added tax (VAT), and contributions to National Insurance. In the UK, limited corporations are given advantageous tax status if a specific income level is reached. There is a flat 19% corporation tax rate.

However, because there is no legal separation between the firm and its owners, unincorporated businesses—such as sole proprietorships and conventional partnerships—do not offer owners complete limitations on liability. The proprietors of such a business would be liable for its debts if it went bankrupt.

Types of Limited Companies

Many countries have formalized limited company structures, but the laws that regulate them can vary significantly from one country to the next. For instance, private limited corporations and public limited firms exist in the United Kingdom.

Public offerings of shares are prohibited for private limited enterprises. Still, these are the most widely used small business structures. Public limited companies (PLCs) may sell shares to the general public to raise money. Once a minimum share value of GBP 50,000 is reached, the shares can be traded on a stock exchange. Larger businesses frequently use this kind of structure.

A limited company is more frequently called a corporation (Corp.) or an incorporated business (Inc.) in the United States. The suffix Ltd. (limited) may be used after a company name in certain states. Obtaining such a designation requires submitting the appropriate documentation; liability protection is not conferred by merely appending the suffix to a firm name. In the United States, limited firms are required to submit an annual company tax return to regulators. The structures of limited corporations and limited liability companies (LLCs) are dissimilar.

There are distinctions between public and private limited firms in several nations. For instance, a private limited company that cannot issue shares in Germany is designated as a GmbH. In contrast, a public limited company that can offer shares to the public is designated as Aktiengesellschaft AG.

Conclusion

- A limited company (LC) is a broad name for a type of business organization in which the assets and income of the shareholders are separate and distinct from the assets and income of the firm; this is known as limited liability.

- As a result, shareholders’ potential losses are restricted to the amount invested, while personal assets and income are prohibited.

- Limited businesses come in various forms, followed by conventional abbreviations such as Ltd., PLC, LLC, and AG, to mention a few.