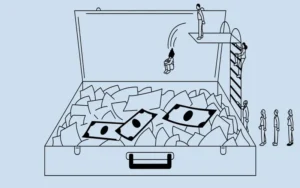

What is the lifetime cost?

A car, a house, or a piece of industrial machinery’s lifetime cost is an estimate of what it will cost to possess the item over its anticipated useful life. The initial cost of buying the item is also included.

Comprehending and Estimating Life Cycle Cost

Businesses usually estimate lifetime costs before committing to significant upgrades, renovations, or expenditures. When purchasing a new piece of machinery, for instance, they will consider not only the original cost but also the cost of operation and maintenance over the equipment’s anticipated lifetime. Other terms for lifetime cost include whole-life cost, life cycle cost, and total cost of ownership.

Individual consumers may find it helpful to compute the lifetime cost before purchasing a home, boat, car, or other costly object. In addition to the purchase price, other lifetime expenses may consist of:

- The price of keeping the thing in a functional or pleasing state

- The price of any insurance to safeguard the object

- Any repairs or enhancements that the item could need.

For instance, if someone purchased a fur coat, the lifetime cost would include the coat’s original price plus any additional costs for cleaning, storing, insurance, and other upkeep.

An item’s lifetime cost can be substantially more than its original purchase price. For example, many boat owners will understand the validity of the proverb that says a boat is just a hole in the water that you can put money into.

Examining an expenditure’s opportunity cost and its lifetime cost can be helpful. This alludes to the possible advantages of allocating the same sum of money differently, like investing it.

How Debt Increases Lifetime Expenses

Repayment of debts is another factor in lifetime costs. For instance, the lifetime cost of a product financed by a credit card or line of credit (LOC) may be significantly more than the price if the purchase had been made with cash. The interest and fees on the credit card or credit line will increase the item’s lifetime cost if the debt is paid off after some time.

For most people, buying a house would be the most dramatic example. For illustration purposes, let us take a $300,000 house bought with a 20% down payment and a 30-year mortgage at a 7% annual rate.

When the mortgage is completely paid off, the homeowner will have paid roughly $335,445 in interest on the $240,000 borrowed, assuming they keep the house and mortgage for the following 30 years. Their original $60,000 down payment, the $240,000 principle paid back on the loan, and the $335,445 in interest will have added up to $635,445—more than double the original purchase price—for the $300,000 house.

Of course, that doesn’t account for all the other expenses a homeowner may incur throughout their lifetime, such as regular upkeep, homeowners insurance, and property taxes. The potential cost of using that money differently needs to be included.

Example of Lifetime Cost in the Real World

Before making a purchase, consumers of cars frequently research several dealers’ financing offers, types and models, prices, and desired amenities. But the car’s expense doesn’t stop at the dealership.

Think about the price of regular oil changes, weekly gas fill-ups, motor insurance, licenses, and car inspections. Additional costs include roadside assistance plans, car washes, and parking or garage fees.

Therefore, it makes sense to consider the vehicle’s original and recurring costs when creating a budget. Certain cars are not only more affordable than others, but they could also require less maintenance. Additionally, a car that is initially more expensive may cost less every year, making it a superior investment over time. Depending on how much they drive, users can compare the running costs of up to eight different brands and models using the Vehicle Cost Calculator available online from the U.S. Department of Energy.

As per the American Automobile Association, the average cost of owning and operating a new car is $9,282. This covers depreciation, license and registration costs, insurance, maintenance, gasoline, and loan finance charges.

Describe Depreciation.

A depreciation accounting technique spreads an item’s cost throughout its useful life. For instance, an office equipment item with a five-year estimated lifespan would depreciate by 20% annually until it was entirely written off. When calculating an item’s lifetime cost, depreciation is frequently considered.

How quickly do cars lose value?

The rate at which a car depreciates might differ significantly between models. A new car may often lose 20% of its value in the first year and an additional 10% to 15% annually over the next five years, according to the lender, Capital One.

Residual Value: What Is It?

What an asset is worth after it has been wholly depreciated for accounting purposes is known as residual value. If another buyer can purchase the item, the seller will receive a portion of the item’s estimated lifetime cost back. For example, even after many years of ownership, an automobile may still have some value for trading in or resale.

The Bottom Line: When making expensive purchases, lifetime cost can be a significant factor when estimating how much an item will cost to own.

Conclusion

- The lifetime cost of an item includes the cost of purchasing it and the cost of operating and maintaining it over its estimated lifetime.

- Whole-life cost, life cycle cost, and total cost of ownership are other terms for lifetime cost.

- Lifetime expenses can far outweigh an item’s original price, making them a significant factor to consider when purchasing.

- The term “opportunity cost” refers to what a customer or business might have received if the money had been used for a different purpose, such as investing.