How Do Lien Sales Occur?

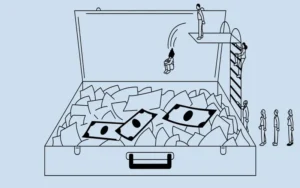

The claim—or hold—placed on an asset to satisfy an outstanding debt is sold at a lien sale. Lien sales are usually held as open auctions, with the lien being on personal property such as cars, real estate, and other items.

Contractors, suppliers, and subcontractors may place liens on real estate they have worked on in anticipation of payment for services provided, according to the laws of the state in which they are employed.

The Process of a Lien Sale

Purchasing overdue tax liens at auction is a growingly common way to invest and is comparable to buying a long-term Certificate of Deposit (CD). Tax liens, however, must be held until they are paid back, unlike CDs, which can be sold back to the taxing authorities. A predetermined rate of return is usually applied when the acquired lien is redeemed within a predetermined window of time.

The amount due may increase due to lien sales for outstanding debts on a property. When a local government agency sells the lien debt, the buyer may choose to work with a lien servicing company, which could result in additional fees and interest being added to the lien. As a result, the buyer can now see a return on their investment because the debtor is now required to cover the additional expenses.

Before a notice is issued specifying the approaching date of the auction, the debtor will frequently get many notices of an upcoming lien sale.

Some exceptions protect a debtor’s property and other assets from going up for auction in case of a lien sale, even though they may still owe taxes and other fees. Veterans, older adults, and homeowners with disabilities, for instance, may be exempt.

Military personnel on active duty may also be immune from having their property subject to lien sales. Every jurisdiction will have requirements, application procedures, and deadlines for contacting the relevant agency.

A lien buyer is only able to charge a certain amount of interest. State-by-state variations exist in interest rate caps set by the government. The highest bidder will win in an auction-style bidding process. The amount that the buyer pays for the lien is crucial because there is a cap on the interest rate that the winning bidder can charge.

Sample of a Sale of Lien

Put a cap on your most excellent bid, for instance, if the maximum interest rate that can be charged for a lien is 12%. It is preferable if the winning bid is lower. A buyer wishes to reduce the possibility of not receiving payment promptly because this market is competitive.

Puy, paying a 2% premium rather than a 9% premium is far preferable. You also have the option to charge up to a 12% interest rate.

Particular Points to Remember

By arranging payment plans to settle their outstanding debt, property owners up for a lien sale can have their property removed from the sale.

Certain lien sales may follow specific protocols, such as an auction for a car with a specific value. If the owner doesn’t pay their bills to the storage firm on time, the procedure for handling that may differ from a lien sale for the contents of a self-storage unit.

Lien sales notices may be published in local media or on the supervising local agency’s website.

Conclusion

- A lien sale is the sale of a claim or placing a hold on an asset to satisfy an unpaid obligation.

- The controlling local agency may post notices of lien sales online and in local media.

- The amount of interest that a lien buyer can charge is limited.