What were the Lehman Brothers?

The global provider of financial services was Lehman Brothers. It offered investment banking, trading, private banking, research, brokerage, private equity, and related services. This company was among the most significant investment banks in the U.S. until its September 15, 2008, bankruptcy. The subprime mortgage crisis played a significant role in causing and hastening its collapse. Its bankruptcy is still the biggest in history. Lehman Brothers had been in business for 164 years when it filed for Chapter 11.

Knowing about Lehman Brothers

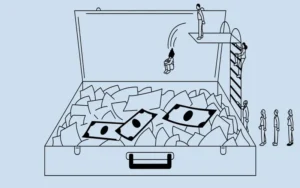

One of the prominent participants in the international banking and financial services sectors was thought to be Lehman Brothers. Lehman was the fourth-largest investment firm in the United States and owned around $600 billion in diversified global assets at its bankruptcy filing. From 1996 to 2006, it made significant investments in mortgage origination in the United States, mainly through leverage, which peaked at over 30:1. Some claim this turned the company into a de facto real estate hedge fund. Lehman Brothers was particularly exposed between 2007 and 2008, when real estate values peaked and started to decline.

The company fought off losses for a large portion of 2008 by cutting expenses, selling assets, and issuing shares (raising debt under such conditions became impossible). It held a sizable amount of subprime and low-rated mortgage loans that it could not sell or declined to do so. The company had a credit constraint due to its illiquid loans, preventing it from paying its creditors. Lehman’s share price dropped due to share dilution and poor sentiment stemming from its inability to raise funds at a low cost through debt issuance. In the meantime, due to the state of the market and the difficulty of obtaining credit, purchasers remained cautious, which resulted in a decline in house prices. The global financial system was in danger of collapsing because no new loans were being provided, and the firm posed a severe risk of failing.

To calm the markets, the Federal Reserve Bank of New York and several significant investment U.S. banks convened on September 12, 2008, to discuss Lehman’s emergency liquidation. The aim was to prevent an expensive government bailout, like the $25 billion loan the government gave to Bear Stearns in March 2008. The talks, which included Barclays and Bank of America as potential buyers, failed due to vetoes from the U.K. Financial Services Authority and the Bank of England. Potential acquirers also failed to win federal participation in their efforts.

Lehman Brothers’ past

After immigrating from Germany, Henry Lehman founded the Lehman Brothers. In 1844, he established a dry goods store in Montgomery, Alabama. When his brothers Emmanuel and Mayer arrived, the store was renamed Lehman Brothers. Their business swiftly grew from trading dry items to cotton and other commodities.

In 1858, the company moved its operations to New York. The commerce of cotton and other commodities took root in the city during that period. While his brothers established the foundation for what would eventually become a dominant force in the banking industry, Henry Lehman oversaw the initial iteration of the grocery and general store industries.

The corporation changed significantly during the next 150 years and entered into several partnerships and affiliations. Even if Lehman Brothers’ failure did not start the Great Recession or the subprime mortgage crisis, it did prompt a significant selloff in international markets.

Today’s Lehman Brothers

Lehman Brothers’ operations, real estate holdings, and assets were liquidated through a fire sale to pay back investors. In less than a month, Japanese bank Nomura acquired the company’s operations in the Asia-Pacific region (Japan, Hong Kong, and Australia), as well as its investment banking and stock trading businesses in the Middle East and Europe. Eleven Barclays acquired both its New York headquarters and its North American investment banking and trading operations. Twelve

In Pop Culture

In addition to being mentioned, Lehman Brothers’ leadership throughout its bankruptcy was portrayed in several financial-themed films that have come out since 2008, including Margin Call, Too Big to Fail, and The Big Short.

Black Monday, a 2019 Showtime series, is a dark comedy centered around a financial crisis. Two fictitious siblings, Larry and Lenny Lehman, who drew inspiration from the real Lehman brothers, appear in the program.

The book Full Circle: A Memoir of Leaning in Too Far and the Journey Back was released in 2016 by Erin Montella, the former chief financial officer (CFO) of Lehman Brothers, who left in 2008. Her experiences in the financial world were the subject of the book. Thirteen

Most famously, Italian novelist and dramatist Stefano Massini wrote a three-act drama titled The Lehman Trilogy. From the time the three immigrant brothers arrive in America and start their dry-goods business until the company’s bankruptcy in 2008, it chronicles their lives.

The show debuted on Broadway in March 2020, ran briefly before the COVID-19 epidemic, and then returned to the stage in the fall of 2021. The play won five Tony Awards, including Best Play, Best Direction of a Play for Sam Mendes, and Best Actor in a Play for Simon Russell Beale. It received eight nominations and received high praise from critics.

Why did Lehman Brothers file for bankruptcy?

Lehman Brothers was compelled to declare bankruptcy after it became apparent that the value of its subprime mortgage portfolio was far lower than initially believed. As Lehman’s stock price crashed, customers started to leave the bank, and eventually, creditors refused to provide it with money. September 15, 2008, was Lehman’s bankruptcy date.

Conclusion

- Lehman Brothers was a world financial company that did trade, brokerage, investment banking, and other things.

- It was the fourth-biggest financial bank in the U.S.

Because of the subprime lending market, the company went bankrupt on September 15, 2008. - People think that its fall made the 2008 financial crisis worse and is one of the most important events in its history.

- Barclays Bank and Nomura Holdings bought Lehman’s assets after the company went bankrupt.