What is a land value tax?

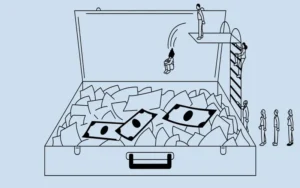

A land value tax, which is not associated with buildings and is calculated exclusively on the value of a parcel of land, is a more predictable method of taxing real estate. A land value tax originated in the earliest agricultural societies, when determining how to tax proprietors equitably for the greater good of society was a shared social objective.

Comprehension of the Land Value Tax

A land value tax (LVT) ensures that land, a finite asset with a fundamental value that remains relatively constant despite the construction of structures on the land, is assessed fairly.

Events that transpire on and near the land are significantly influencing fluctuations in land values. As an illustration, the economic impact of an acre of land in a rural environment might be comparatively lesser than that of an equivalent-sized parcel in a downtown urban locale, potentially adjacent to a developing food distribution facility necessitating an extra cargo dock.

Throughout history, societies have perceived land as a communal asset that should not be possessed in the conventional sense but rather as a rental transferred from one generation to the next. The human activity on it predominantly determines the overall value of a parcel of land. Since this activity is almost always associated with the landowner’s wealth, a land value tax is considered a more equitable method of calculating tax liability. This has resulted in the current taxation system, which assesses land and buildings independently.

LVT is an instance of an ad valorem tax; it is alternatively referred to as a site valuation tax. The Latin phrase Ad Valorem translates to “by value.”

Contemporary illustrations of this phenomenon are frequently encountered in the yearly municipal land assessments that householders are required to pay, wherein the value of their land is assessed independently of the buildings on it.

A proprietor can alter its taxable value by constructing additions to the structures on the property. However, the value of the land tends to remain more stable over time. Conversely, the situation changes when a landowner permits his structures to deteriorate. In this scenario, the community will receive reduced property taxes overall while the intrinsic value of the land remains relatively consistent with its initial valuation. This characteristic holds significance for prospective purchasers who weigh their tax obligations against the genuine worth of the asset they are acquiring.

Loss of deadweight and the land value tax

Market trends predominantly influence property value fluctuations and can exhibit remarkable volatility. Deadweight loss is what economists refer to as the damage these changes cause to society.

Such expenditures as police, fire, and rescue have far-reaching adverse effects on the ability of a prosperous society to finance its essential services.

By establishing a more stable system of real estate taxation that distinguishes the value of the land from that of the structures, the land value tax assists in mitigating these market fluctuations.

Conclusion

- A land value tax (LVT) is a way to figure out how much to charge for property taxes that only looks at the value of the land and any changes that go with it, not the buildings built on the land.

- People believe an LVT is a fairer way to tax land in farming areas where the land is valuable.

- Some experts like ad valorem taxes, like land value taxes, because land value tends to be more stable than the value of homes or other buildings.