Describe Kappa.

A coefficient known as Kappa assesses an option contract’s price sensitivity to changes in the underlying asset‘s volatility. Future price movements, past price changes, and recent fluctuations are all considered volatile. Volatility is a term used to describe the degree and rate of change in the price of a trading instrument, such as an option.

Comprehending Kappa

One of the four main Greek risk measures, known by their Greek letters, is Kappa, commonly referred to as vega. As the “v” in vega means “volatility” and the “t” in theta means “time,” it is sometimes called Kappa even though vega is not an actual Greek letter. Several elements affect the prices of options contracts. When studying options, traders employ the option Greeks, which are four techniques to assess factors that affect the price of an option. The Kappa, theta, gamma, and delta risk measures show how susceptible an option is to changes in implied volatility, time-value decay, and the price of its underlying security.

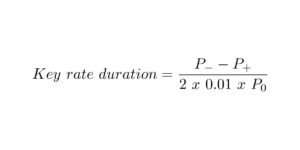

By estimating how much the price of an option contract fluctuates in response to a 1% shift in the underlying asset’s implied volatility, Kappa quantifies risk. The farther away an option’s expiration date is, the larger the Kappa. As the expiration date draws nearer, the price of an option becomes more susceptible to changes in the value of the underlying asset, which causes Kappa to decrease. (Options with an instant expiration have a negative kappa.) This is because options with future expirations are allocated higher premiums than options with immediate expirations.

Kappa fluctuates when significant price swings exist in the underlying asset, which signals volatility. When the option approaches its expiration date, Kappa decreases. Kappa measures the price change for every percentage point that implied volatility changes. Implied volatility is a forecast; actual future volatility may differ from it. A model that ascertains what the current market values are predicting for the future volatility of an underlying asset is used to calculate implied volatility.

It is possible to compute Kappa for both individual and portfolio choices. Kappa is called net Kappa when it is calculated for an options portfolio. The sum of the kappas for each position is the net kappa.

Gamma, Theta, and Delta are the remaining three Greek possibilities. Delta calculates the effect of a price change on the underlying asset. It is a ratio that contrasts the price movement of an asset—typically marketable securities—with the price movement of its derivative. Gamma measures the rate at which the delta of an option changes for each one-point change in the underlying asset’s price. Theta calculates the price impact over time or its time decay.

Conclusion

- It is a way to measure how sensitive an option contract’s price is to changes in how volatile the underlying asset is.

- Kappa is one of the four main Greek risk measures. It is also known as vega. The names of the measures come from the Greek letters that stand for them.

- To figure out how risky something is, Kappa figures out how much an option contract’s price changes when the underlying asset’s implied volatility changes by 1%.

- Kappa, theta, gamma, and delta are a group of risk measures that show how sensitive an option is to changes in the price of its underlying security, changes in implied volatility, and time-value decay.