What is a horizontal line?

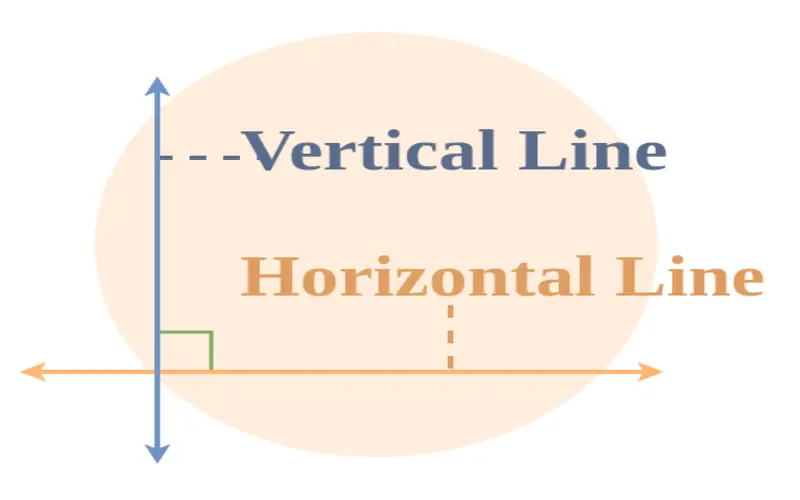

Technical analysis uses a horizontal line on price charts to indicate support or resistance zones. Geometrically, horizontal lines are parallel to the x-axis. An utterly horizontal line has the same y-value for all values.

Understanding Horizontal Line

Technical analysis sometimes uses horizontal lines to indicate support, where the price stopped dropping and bounced, or resistance, where the price stopped rising and fell.

To design a horizontal support line, link comparable swing lows in price. Connect identical swing highs for a horizontal resistance line.

Analyzing or trading with the horizontal line follows. If an asset price fluctuates between horizontal support and resistance lines, it is termed range-bound.

A fall below the support horizontal line might imply a price decrease, but prices may rise if they hold and bounce higher. The same ideas apply to horizontal resistance lines. If prices break resistance, they may rise. If resistance holds and the stock falls, traders will monitor for lower prices.

A horizontal line is when the y-axis values are equal on any chart. If it shows a sequence of highs in the data, a data point above the horizontal line indicates a y-axis value increase above recent data sample values.

Fundamental Horizontal Analysis

Horizontal analysis compares values or prices throughout time. An analyst compares earnings reports and statements over time as part of fundamental research. Time is the horizontal x-axis in this study, allowing analysts to calculate percentage changes across time to depict change.

Horizontal analysis examines financial statement trends over many periods using a base period and provides dollar and percentage changes.

Divide the dollar change between the comparison year and the base year by the base year item value, then multiply by 100 to get the percentage change. When someone says revenues climbed 10% this quarter, they use horizontal analysis.

Horizontal analysis, applicable to all financial items, including sales and EPS, aids in comparing firm performance.

Horizontal Lines and Supply-Demand Curves

To construct supply-and-demand curves, place the price on the vertical axis and the quantity required on the horizontal axis. An utterly horizontal supply and demand curve implies perfect elasticity, meaning demand responds instantaneously to price changes. Increasing the price of an utterly elastic commodity or service over the market price leads to zero demand. With complete elasticity, buyers won’t pay more than a specific price.

Examples of Technical Analysis: Horizontal Line Use

A horizontal line is one of the simplest technical analysis methods, yet it delivers essential information. The SPDR S&P 500 (SPY) exchange-traded fund (ETF) chart below shows a horizontal line.

An uptrend occurs when prices experience higher swing highs and lows. Thus, a horizontal line might indicate an uptrend when the price makes a new high. The SPY chart above shows an uptrend with the price above the horizontal line. The price falling below the horizontal line may indicate an uptrend failure and lower pricing.

Moving over the horizontal line is bullish since it functions as a line in the sand.

The Difference Between Horizontal and Trendlines

Both phrases might mean chart lines. Although horizontal lines are horizontal, trendlines are usually slanted and drawn along rising swing lows or falling swing highs during downtrends.

Technical Analysis Horizontal Line Limitations

A horizontal line doesn’t inhibit pricing. This technical tool can help traders decide whether to be bearish or bullish.

A horizontal line’s location is subjective. Traders may set the horizontal line at different prices.

The price may whipsaw around a horizontal line at critical values. This might lead to misunderstandings or losing transactions until the price moves above or below the line.

Conclusion

- Technical analysis uses horizontal lines to define support and resistance.

- Horizontal lines parallel the x-axis.

- The technical analysis draws the horizontal line along a swing high or sequence of swing highs that halted at a comparable level. The same goes for swing lows.