Describe the Hikkake pattern.

Technical analysts and traders utilize the hikkake pattern to predict market direction. One configuration implies a short-term price decline, while the other implies a price rise.

Understanding Hikkake Pattern

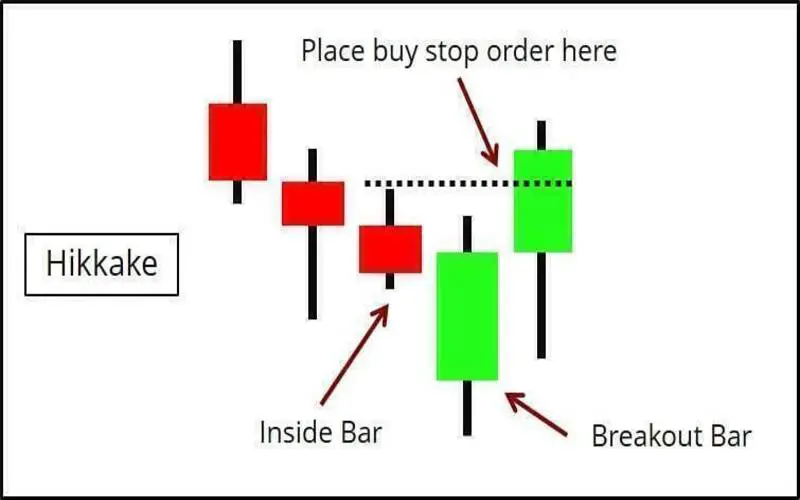

Hikkake patterns, pronounced Hĭ KAH kay, are complicated bar or candle patterns that suddenly change course, indicating a potential move in the other direction. Dan Chesler, CMT, created this design in 2003 and provided a description. The pattern comprises four main points:

- The first two candles (or bars) are shrinking. This is known as an inside-day pattern or harami candlestick pattern. Whether either day finishes higher or lower than it started doesn’t matter as long as the first fully overshadows the second.

- The third candle closes below the second candle’s low in the first setup (or above high in the second setup).

- One or more candles will wander below (or above in the second setup) the third candle and may reverse course.

- The final candle will close above the second candle’s high (or below its low in the second setup).

The pattern suggests a continuance in the final candle direction after the fourth characteristic. The following charts illustrate both settings.

First, the bullish setup pattern These examples highlight when the four traits occur. Second, the bearish setup pattern is rare.

The Japanese phrase for this design means “hook, catch, ensnare.” Chesler initially coined the hikkake pattern to explain a pattern he had discovered that might trap traders who commit capital to a market only to see it move against them.

The hikkake pattern involves a short-term market volatility drop and a price breakout. The third candle in the pattern will lead traders to believe a breakout has occurred. Market traders enter and place a stop in the other direction. If the price pattern reverses, traders’ stop-loss orders may raise the price when they cross the second candle boundary (where stop orders are expected).

Sample Hikkake Pattern

The price movement for Microsoft (MSFT) shares followed this pattern, which occurs around half the time. This chart shows the bullish setup with all four features.

A rectangle highlights the price pattern, indicating a bullish advance in the days ahead. The chart rose somewhat after exiting the enclosed area. Hikkake patterns don’t always predict correctly.

Conclusion

Technical analysts and traders utilize the hikkake pattern to predict market direction.

One configuration implies a short-term price decline, while the other implies a price rise.

The hikkake pattern appears to function by traders expecting the price to move one way and then bailing out when it reverses.