What is the Fama-French Three-Factor Model?

The 1992 Fama and French Three-Component Model adds size and value risk elements to CAPM’s market risk component. This model recognizes that value and small-cap companies consistently beat markets. Adding these two features adjusts this outperforming propensity, giving the model a more robust management performance tool.

How to Understand Fama and French’s Three-Factor Model

Nobel Laureate Eugene Fama and former University of Chicago Booth School of Business professor Kenneth French concluded that value companies beat growth stocks in their research to assess market performance better. Also, small-cap stocks outperformed large-cap ones. As an assessment tool, portfolios with many small-cap or value stocks perform worse than the CAPM result because the three-factor model accounts for outperformance.

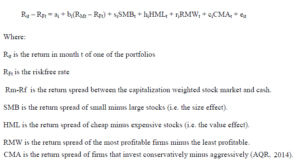

Firm size, book-to-market values, and market excess return comprise the Fama and French models. Small minus big (SMB), high minus low (HML), and portfolio return minus risk-free rate are employed. SMB is for publicly listed firms with lower market capitalization that create better returns, whereas HML is for value equities with high book-to-market ratios.

There is much dispute over whether market efficiency or inefficiency causes outperformance. Value and small-cap firms’ higher capital costs and business risk are the reasons for outperformance, which supports market efficiency. The outperformance is defined by market participants erroneously valuing these enterprises, which gives the extra return when the valuation adjusts, helping market inefficiency. EMH-supporting investors are more inclined to support efficiency.

The formula is:

File Photo: FAMA And French Three-Factor

Investors must be ready to handle short-term volatility and underperformance, according to Fama and French. Long-term investors for 15 years or more will be rewarded for short-term losses. After testing their model on hundreds of random stock portfolios, Fama and French discovered that size, value, and beta explained 95% of diversified stock portfolio performance.

Since relative risks explain 95% of a portfolio’s performance versus the market, investors may create a portfolio with an average predicted return. The book-to-market ratio measures market, size, and value stock sensitivities, which drive expected returns. The additional average anticipated return may be due to unpriced or unsystematic risk.

Five-Factor Model

Recently, researchers have added components to the three-factor model. In addition to “momentum,” “quality,” and “low volatility,” Fama and French added five features to their model in 2014. In addition to the original three criteria, the new model incorporates profitability and the assumption that enterprises with higher future earnings have higher stock market returns. The sixth component, “investment,” demonstrates how businesses undertaking significant growth initiatives risk having their stock market value decline.

What Do Fama and the French Three Factor Model Mean for Investors?

The Fama and French Three Factor Model advised investors to endure short-term volatility and underperformance. Long-term investors for 15 years or more will be rewarded for short-term losses. The model can explain up to 95% of a diversified stock portfolio’s return so that investors may adapt their portfolios to their relative risks for an average expected return.

The book-to-market ratio measures market, size, and value stock sensitivities, which drive predicted returns. The additional average anticipated return may be due to unpriced or unsystematic risk.

What are the three model factors?

Firm size, book-to-market values, and market excess return comprise the Fama and French models. The three components are SMB (small minus large), HML (high minus low), and the portfolio’s return minus the risk-free rate. HML is for value shares with high book-to-market ratios, whereas SMB is for publicly listed enterprises with smaller market capitalizations that provide superior returns.

Fama with a French Five-Factor Model

Fama and French added five features to their model in 2014. In addition to the original three criteria, the new model incorporates profitability and the assumption that enterprises with higher future earnings have higher stock market returns. The sixth component, “investment,” demonstrates how businesses undertaking significant growth initiatives risk having their stock market value decline.

Conclusion

- To the market risk parts of the Fama French 3-factor model, size and value risk variables are added to make the capital asset pricing model bigger.

- Nobel laureates Eugene Fama and Kenneth French created the concept in the 1990s.

- Historical stock prices were regressed to create the model.