In Q4, data shows that “younger” BTC purchased at the summer $30,000 lows is moving.

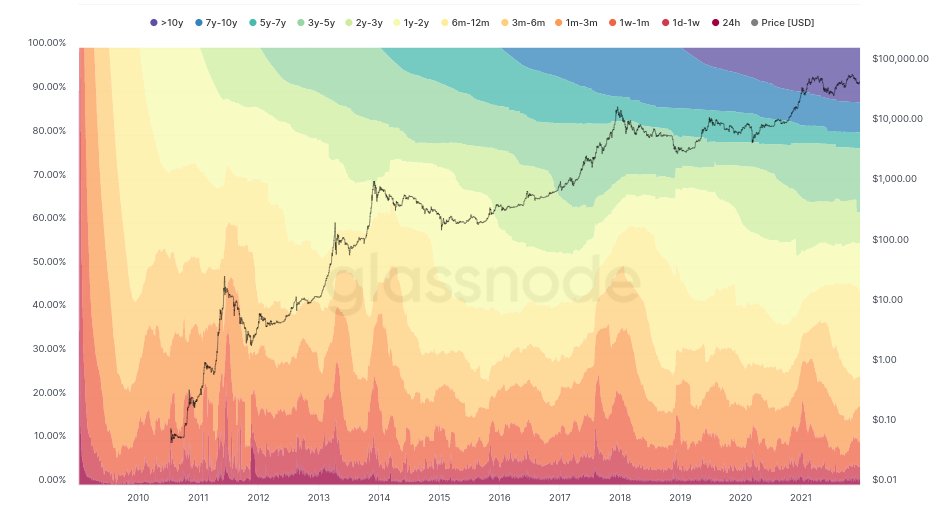

Despite reaching all-time highs of $69,000 this year, data shows that seasoned Bitcoin (BTC) hodlers have barely spent any coins.

The proportion of coins spent by old hands remains near record lows, according to the Coin Days Destroyed (CDD) metric from on-chain analytics firm Glassnode.

Strong hands knuckle down in 2021

CDD remains extremely calm, which is the latest sign of the conviction of those who have invested in and held Bitcoin for a long time.

Each time a BTC moves, the indicator refers to how long it has been dormant. Simple volume measurements are no longer sufficient to determine market trends. As a result, older coins are more “important” than newer coins with a history of active circulation.

Read more on: Countdown to the end of the year: 5 things to keep an eye on in Bitcoin this week

“Despite a recent increase, the current value is still near historic lows,” the Twitter account UTXO Management summarized alongside a screenshot of the chart.

Strong hands have remained firm since a spike in old hand selling after BTC/USD crossed 2017’s all-time highs of $20,000 last year, according to the data.

Even the recent rally to nearly $70,000 failed to significantly break the trend, and new market entrants continue to sell.

Summer buyers are sellers in the winter

Unchained Capital’s Hodl Waves metric confirms this: coins purchased between three and six months ago now account for the largest reduction in overall supply.

This means that sellers bought their bitcoins between June and September of this year when the price of bitcoin fell to $30,000.

As reported by Cointelegraph, clear distinctions between different groups of hodlers have long been scrutinized.

Even those who bought at $20,000 are doubling down, as BTC/USD is expected to end 2021 at around $20,000 higher than it was in January.

Meanwhile, senior analyst Dylan LeClair of UTXO Management noted last week that hodlers are adding to their positions, in general, this month.

(@DylanLeClair_)

(@DylanLeClair_)

Comment Template