China Evergrande Group (3333. HK) announced on Friday that the parameters of a planned offshore debt restructuring arrangement were being changed to accommodate the company’s needs and the demands of its creditors.

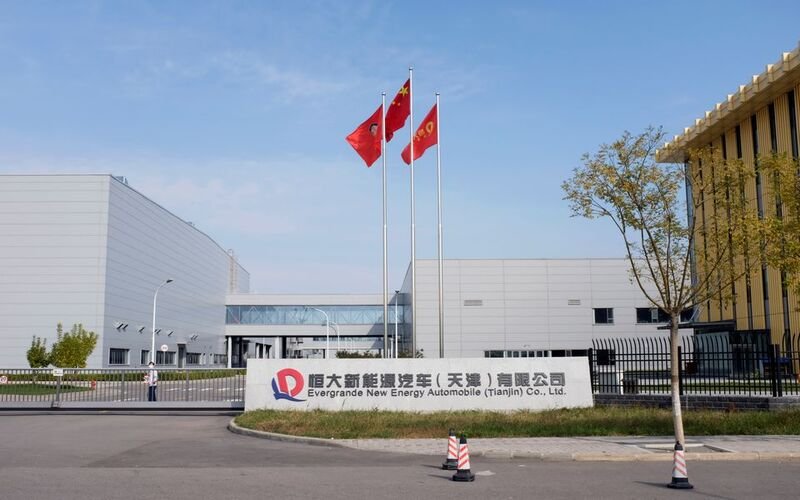

Late last month, Evergrande, the company at the center of China’s debt problem in the real estate industry, said that its billionaire founder was under investigation for an undefined offense.

Additionally, it stated that a current inquiry into its primary business prevented it from issuing fresh debt, an essential stage in restructuring.

The troubled property developer’s bondholders expressed anxiety about a potential liquidation last week after learning that its restructuring plan didn’t comply with legal regulations.

The hearing for the company’s application to the U.S. bankruptcy court, which was set to take place on October 25, has been postponed, according to the developer’s filing on Friday, which also stated that the scheme sanction hearings for Hong Kong CEG-class debt holders and the TJ scheme had been annulled.

The destiny of China Evergrande extends beyond Chinese territory. There could be effects on international financial markets, particularly those that foreign investors and institutions use. Global financial experts are keenly monitoring the changes made to the restructuring plan as they try to predict how the crisis will develop and how it will affect the whole economy.

Finally, the latest restructuring plan from China Evergrande represents a significant shift in the continuing financial turmoil. The company’s future is about to change due to changes in loan repayment conditions, asset sales, and government support, which will also impact the state of the global financial system. Stakeholders inside and outside of China are closely monitoring this scenario as it changes and waiting for new developments and answers.