China Evergrande loses $2.4 billion in value as trade resumes after 17 months. As of August 28, 2023, Evergrande’s shares have experienced a significant decline, plunging by more than 80%. This dramatic drop in share value comes as trading in Evergrande shares resumes after a 17-month hiatus.

Background on Evergrande

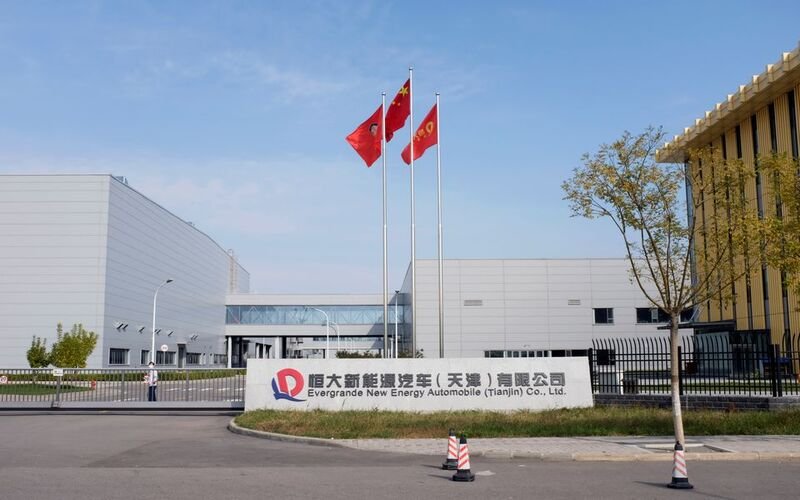

Evergrande Group is one of China’s largest property developers, with a vast portfolio of real estate projects spanning residential, commercial, and other sectors. Historically, the company has been a major player in the Chinese real estate market, contributing significantly to the country’s rapid urbanization.

The Financial Challenges

The sharp decline in Evergrande’s share price reflects the financial challenges the company has been facing. Evergrande’s financial woes became a focal point in 2021 when it struggled with mounting debt. The company’s debt load raised concerns about its ability to meet its financial obligations, including repaying creditors and completing ongoing construction projects.

Impact on Investors

Evergrande’s financial troubles have had far-reaching consequences, affecting the company and its investors, bondholders, and the broader financial markets. The decline in share value has resulted in significant losses for shareholders who held Evergrande stock.

Suspension of Trading

Chinese authorities suspended trading in Evergrande shares for 17 months to address the financial turmoil. This suspension was aimed at stabilizing the market and preventing further panic selling. During this period, Evergrande’s financial situation remained uncertain, contributing to the anxiety surrounding its eventual return to trading.

Resumption of Trading

The resumption of trading in Evergrande shares on August 28, 2023, marks a significant development in this ongoing financial saga. It allows investors to assess the current state of Evergrande and make informed decisions regarding their investments.

Future Uncertainty

While trading has resumed, the future of Evergrande remains uncertain. Market participants and regulatory authorities will closely monitor the company’s ability to manage its debt, complete its real estate projects, and restore investor confidence.

In conclusion, the resumption of trading in Evergrande shares after a 17-month hiatus is a critical event that underscores the challenges faced by this prominent Chinese real estate developer. The significant drop in share prices reflects the financial concerns that have plagued the company, and its future remains uncertain as it navigates its complex financial situation. Market observers will watch developments related to Evergrande with keen interest as they have broader implications for the Chinese real estate market and global financial stability.

Comment Template