A thorough investigation of the thirteen-year-old Bitcoin (BTC) ecosystem reveals intriguing patterns that are naturally driven by market circumstances and investor mood. For example, the ecosystem revealed a cycle in which per transaction prices inevitably decrease every four years as BTC’s cost per transaction dropped to $56.846 on July 14.

Data from Blockchain.com shows a pattern that many would find gratifying. The cost per Bitcoin transaction is computed by dividing miners’ earnings by the total number of transactions.

From its all-time high of $300.331 in May 2021, the cost per transaction decreased by over 81 percent by July 2022, which may be attributed to a combination of a protracted bear market and a decline in on-chain transactions because of governmental restrictions placed on retail investors.

But every four years, there is a pattern in the increase and decline of the cost per transaction. For example, the price per transaction for Bitcoin has gone through its rollercoaster cycle three times since its 2009 launch: in 2014, 2018, and 2022.

The cost per transaction would surpass the present all-time high by 2026 if history were to repeat itself regardless of market circumstances, followed by a final decline to the $50 level.

The income from mining Bitcoin has generally decreased throughout the year 2022, with July seeing the lowest monthly income in more than two years.

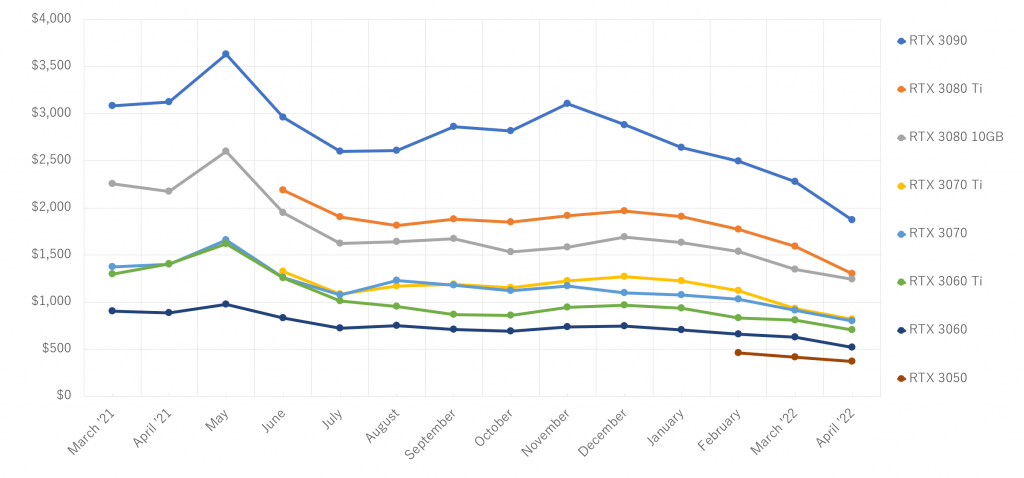

Due to the substantial operational expenses involved in mining BTC, Bitcoin miners were adversely affected by the declining market prices and found themselves barely generating money. However, since miners have access to inexpensive mining equipment, lowering graphic card or GPU prices is expected to offset the losses.

After the worldwide chip bottleneck was resolved and card makers resumed production, GPU prices fell precipitously, with some cards going for less than their MSRPs. As a result, mining equipment costs decreased by an average of almost 15% in May 2022 because there was more supply than demand.

Read more:

Comment Template