APPLE’S PUSH INTO NEXT-GENERATION FINANCIAL SERVICES HITS DELAYS

Apple is trying to navigate many unanticipated hurdles in its quest to modernize the financial services sector, making the company’s future questionable.

KEY TAKEAWAYS

- Apple has introduced various new products and solutions to shake up the financial services industry.

- The technological giant has seen a series of setbacks that have hindered them from making significant advances.

- It is still being determined at this time whether Apple will be able to achieve its objectives despite the obstacles that stand in its way.

- The company’s future could be better as they seek to go on with its ambitions.

INTRODUCTION

Since its establishment in 1976, Apple Inc. has dominated the technology sector and continually sought new methods to develop within the mobile sector and beyond. The business declared its ambition to enter the financial services industry more deeply this year, with plans to provide a credit card and a digital payment service. However, the internet giant’s struggles with many issues have caused delays in the push toward the next generation of financial services.

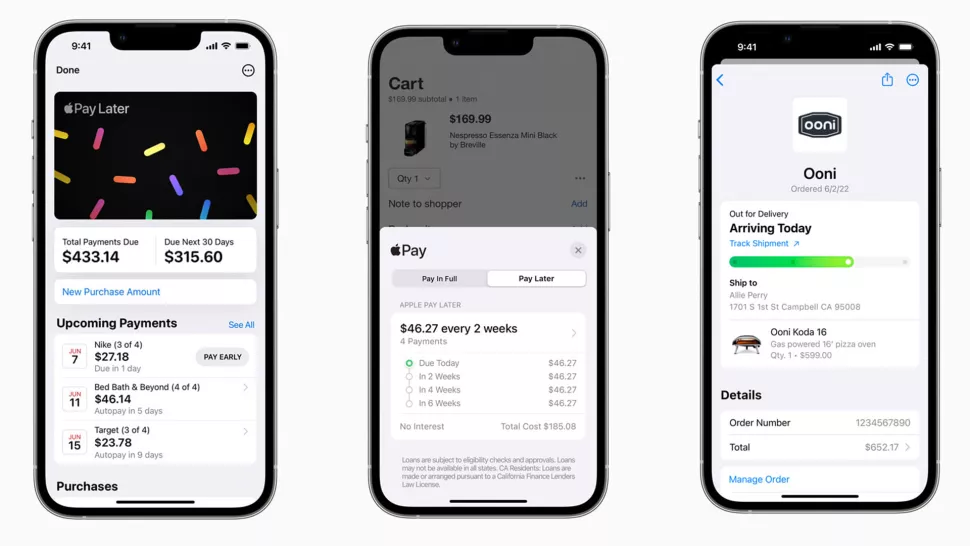

With the release of Apple Pay in March 2019, Apple entered the digital payment industry public. Users may easily save their payment information with Apple Pay and use their Apple devices to make payments. The Apple Card, a credit card that works with the Apple Wallet, was introduced in August 2019. The Apple Card is a rewards program with enhanced security, a straightforward user interface, and integration with the Apple ecosystem.

There are several obstacles in Apple’s attempt to enter the financial services industry. First, the business must abide by banking standards and be governed by state and federal entities. This indicates that the necessity for regulatory approval has caused a considerable delay in the launch of the Apple Card.

Additionally, Apple faces competition from established banking and financial services players. It is challenging for a newcomer like Apple to achieve market share since these suppliers have large client bases and extensive expertise.

Apple also needs help from the general public. Despite the brand’s reputation for producing high-quality goods, some customers might need more support to entrust a technological business with their financial information. For Apple to win over these customers’ business, it must establish trust.

Finally, Apple faces competition from other companies that offer digital payments, including PayPal and Venmo. These companies have more experience in the field and established clientele. Apple needs to find a method to set itself apart from the competition with its services.

APPLE’S AMBITION TO REVOLUTIONIZE FINANCIAL SERVICES

Since it entered the banking sector a few decades ago, Apple has made sporadic attempts to revolutionize it. Early in the new millennium, Apple introduced Apple Pay, a payment platform that lets users store credit cards and pay with their iPhones or Apple Watches. Despite being a success, Apple Pay did not substantially influence the banking sector.

Photo: Apple

Apple revealed its intention to start a banking service in 2013, giving users access to financial management tools within the Apple ecosystem. However, in 2015, the project was put on hold because of operational and regulatory issues.

Despite the setback, Apple has kept working on its goal of revolutionizing financial services. The business revealed intentions to provide Apple Pay Cash, a peer-to-peer payment service, in 2016. Using their iPhones or Apple Watches, members of the service may send money to one another. After being formally introduced in 2018, the program quickly gained enormous popularity among Apple customers.

Recently, Apple announced a credit card launch with Goldman Sachs called the Apple Card. The card provides customers with many perks, including rewards and no fees. It was introduced in March 2019 and has gained much popularity since then.

REASONS BEHIND DELAYS IN APPLE’S FINANCIAL SERVICES

Apple’s attempt to enter the market for cutting-edge financial services has encountered several obstacles. Several possible explanations exist for this phenomenon, including regulatory worries, competition, and technology limitations.

Apple’s reluctance to enter the financial services industry may be attributed, in large part, to worries about regulatory compliance. The firm must still get the necessary licenses and regulatory approvals from the relevant authorities to deliver its financial services effectively. The process might take a long time since so many regulatory hoops exist.

Governments and their different agencies have enacted many stringent regulations that must be adhered to in the financial services industry. The process for obtaining the required permits and licenses is further delayed due to Apple’s obligation to ensure that its financial services comply with all applicable standards and laws.

Competition from other companies has also slowed Apple’s expansion into the financial services industry. Banks, fintech startups, and other well-known financial service providers are some of the biggest names in the market with whom the company must compete. These businesses have extensive experience and expertise in the industry, as well as a solid understanding of the relevant regulations.

It will take more work for Apple to take on these businesses. First, they must invest significant time and money to establish themselves in the market and gain access to the required technology, partnerships, and regulatory approvals.

Lastly, Apple’s entrance into the financial services industry has been delayed due to technical limitations. Many technologies, such as big data, cloud computing, and machine learning, are heavily relied upon by the firm to enhance its financial services. Still in their infancy, these technologies have yet to mature to the point where they can be effectively applied to the development of financial services.

Delays in the development process have been caused by the organization’s need to take the time to thoroughly research, develop, and test the various technologies before they can be implemented.

POTENTIAL SOLUTION TO THE DELAY

There has been a temporary halt to Apple’s entry into the financial services industry due to delays in releasing the Apple Card credit card. The purpose of this new product was to make it easier, safer, and more beneficial for people to manage their money. Sadly, the initiative has encountered some challenges, including delays in the rollout of the Apple Card.

A possible solution to the backlog is if Apple begins working with existing banks and other financial institutions. For the launch of the Apple Card, these partners can provide the necessary infrastructure and legal compliance. In addition, these partners may also be utilized to provide additional features or benefits that Apple may not be able to provide. As a result, the transfer will go more smoothly, and more people will be interested in getting an Apple Card.

Apple could use its current technologies to develop its financial services further. For example, Apple could use its existing biometric security systems, such as Face ID and Touch ID, to beef up the Apple Card’s protections. With its innate AI and ML prowess, it might also make keeping tabs on and handling finances much simpler for the average person.

Finally, Apple might look elsewhere for inspiration before launching its financial services. For example, it may consider partnering with fintech companies to expand its offerings or developing its digital currency to facilitate faster transactions. It might also consider other payment methods, such as cellular money transfer apps and prepaid debit cards.

CONCLUSION

Apple is optimistic about the future of its next-generation financial services even though delays have slowed its development. The IT behemoth recently made headlines by announcing the launch of its first credit card of any kind, the Apple Card. In addition, apple has acquired a reliable and safe payment infrastructure to enter the financial services industry.

Despite some failures, Apple remains committed to revolutionizing the financial services sector. With the development of reliable and secure payment infrastructure and cutting-edge products like Apple Card, Apple is still on track to have a sizable impact on the financial services sector. Moreover, there is no doubt that Apple’s plans to introduce next-generation financial services will have far-reaching effects on the entire industry.

Comment Template