What is a leveraged employee stock ownership plan (LESOP)?

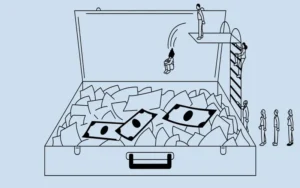

An employee compensation program known as a leveraged employee stock ownership plan (LESOP) involves the sponsoring company utilizing its credit to borrow funds from its treasury to purchase shares to fund the plan. The corporation then contributes annually to the stock ownership plan (ESOP), through which these shares are repaid in full for the initial loan.

Understanding Leveraged Employee Stock Ownership Plans (LESOPs)

Organizations generally opt to utilize ESOPs, or alternative equity compensation schemes, to link a fraction of their workforce’s investments to the company’s stock price performance. By doing so, actively involved employees are motivated to ensure that the company’s operations operate with maximum efficiency and profitability.

By capitalizing on company assets, the organization can fund its stock ownership program and grant employees ownership stakes in the company without requiring them to contribute the required capital promptly. Using the proceeds of bank loans, LESOPs purchase shares of the company’s stock from the business or its current shareholders. The lending bank retains the acquired shares as collateral and customarily demands payment guarantees from the selling shareholders, the company, or the remaining shareholders.

Tax Factors to Bet On

LESOPs function as a tax-efficient approach to funding the expansion of corporations because shares designated for an employee do not incur taxation until distributions are received, which typically transpire after the employee’s separation from the organization.

As a result of tax regulations governing deductions, employer contributions intended for annual loan repayments cannot surpass 25% of the annual compensation of a participating employee. In addition, employers may restrict LESOP participation to personnel who have fulfilled a minimum of one year of service and are at least 21 years of age.

Constraints Regarding the Leveraged Employee Stock Ownership Plan

Although participating LESOP employees benefit from tax deferral, this plan is not devoid of potential drawbacks, the most significant of which is an inherent investment risk.

As a substitute for other qualified retirement plans, LESOPs may be overly concentrated in company stock and lack the diversification of a traditional retirement portfolio (e.g., a 401(k) plan). Upon reaching the age of 55 and having completed a minimum of ten years of participation in an LESOP, employees are allowed to allocate 50% of their accounts to investments other than the equity of their own company over five years.

Moreover, because a LESOP requires borrowing, it can negatively impact a new company’s debt-to-equity (D/E) or debt-to-income (DTI) ratio, diminishing its perceived investment appeal. Furthermore, the lender may seize the assets pledged as collateral if a business cannot pay its obligations.

Conclusion

- A leveraged employee stock ownership plan (LESOP) allows workers to get equity pay by using borrowed money to fund an ESOP.

- The company borrows money against its assets and then makes yearly payments to the ESOP to repay the loan.

- A LESOP is helpful because it means a company doesn’t have to pay upfront cash to set up an ESOP.

- However, it must be done carefully because it means taking on a lot of debt.