What Is a Leveraged Lease?

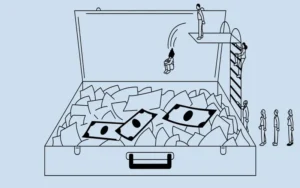

A leveraged lease is a lease that the lessor finances with the assistance of a different financial institution. Utilizing borrowed funds, a leveraged lease involves the rental of an asset.

A Knowledge of Leveraged Leases

The rental of assets intended for short-term utilization is the typical application of leveraged leases. Leveraged leasing typically provides access to assets such as automobiles, trailers, construction vehicles, and business equipment. In a broad sense, leasing denotes the act of a business or person renting an asset.

A short-term use of any form of asset is granted to an entity through leasing. While the asset is typically rented, a purchase option is frequently provided after the lease term in leveraged leases.

Borrowing funds to cover the substantial cost of the asset’s value constitutes the leveraged component of a leveraged lease. A leveraged lease is frequently employed when an entity lacks the capital to purchase an asset wholly and does not inherently intend to retain it for an extended period. Leveraged leases enable lessees to secure a debt in the amount of the leased asset’s value throughout the lease term, with the obligation to repay the loan throughout the lease’s duration. Because the lessee is solely responsible for a specified value that is correlational with the lease term, the loan amount may be less than required to purchase the asset outright.

Lease Structure Leverage

Because leverage is a factor, leveraged leases may be more complicated than standard operating leases. The lessor and their financing relationships will dictate the structure of the leveraged lease terms. In this case, the financing institution that grants the loan also serves as the lessor, thereby approving the loan on behalf of the borrower. Additionally, the lessor might partner with a third-party lender. When a loan is authorized, the lessor is granted possession of the asset immediately upon the third-party lender’s provision of the borrowed funds. There are instances in which a lessor may contribute some funds in addition to funds borrowed from a third party, which may assist in enhancing the lease’s terms.

The borrower acquires the asset and assumes the obligation of making periodic payments toward the loan balance following the approval and agreement of a leveraged lease. Typically, the lessor or the lender holds title to the asset, contingent on the structure. In any case, no title transfer occurs to the lessee during the term of the leveraged lease.

Always remember that a secured loan typically provides collateral for a leveraged lease. After non-payment by the lessee, the lessor retains the right to reclaim the asset.

Financing as opposed to leasing

When purchasing a vehicle or other high-value asset, leveraged financing or leasing are typically the primary alternatives for an individual or business. A leveraged lease facilitates the provision of a loan to offset the approximate value of a vehicle throughout the lease term. Lower leveraged lease payments may result from the loan not covering the vehicle’s market value.

An entity may also finance a vehicle; in this case, the car loan is comparable to a housing loan. To redeem the car loan, installments are distributed over an extended period. The purchaser acquires a loan for the complete value of the vehicle.

Particular Aspects to Consider: Leveraged Lease Accounting

While accounting standards for leasing an asset with leverage are typically of little concern to individuals, this could be a significant consideration for a business. Capital leases are the terminology used in business accounting to denote leveraged leases.

Four standards are applied to ascertain the distinction:

- The duration of the lease is at least 75% of the asset’s useful life.

- The lease agreement comprises a bargain purchase option, which grants the lessee the ability to acquire the asset at a future date for a price below its fair value.

- Upon the lease term’s conclusion, the lessee acquires ownership.

- The present value of the lease payments exceeds ninety percent of the asset’s market value.

The classification of the lease as either an operating lease or a capital lease is determined by whether or not any of these conditions are fulfilled. In general, the treatment of capital leases is analogous to an asset purchase in accounting. In general, lease payments must be recorded as operating expenses in operating lease accounting.

Comparing Operating Leases to Leveraged/Capital Leases

The distinctions between a leveraged/capital lease and an operating lease may interest individuals and businesses. Typically, operating leases do not encompass purchasing alternatives for the leased asset. Building and apartment leases are prevalent forms of operating lease agreements.

In business accounting, it is crucial to distinguish leveraged or capital leases from operating leases because distinct accounting principles govern the two.

Conclusion

- Leveraged leases let a business hire an object for a certain amount of time while using borrowed money to pay for it.

- When a business doesn’t have the money to buy an object directly or doesn’t want to keep it for a long time, it often uses a leveraged lease.

- A capitalized lease is what business accounting professionals call a leveraged lease, and they must follow specific accounting rules.