Definition of Financial System

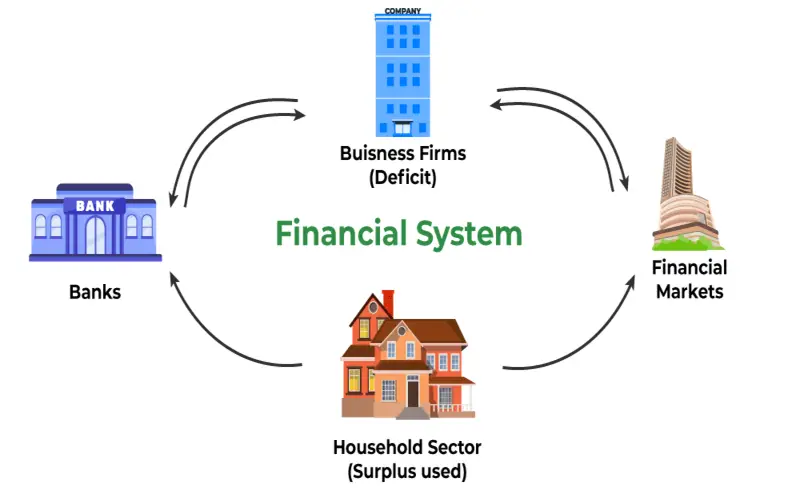

A financial system includes banks, insurance firms, and stock exchanges that allow money transfers. Firm, regional, and worldwide economic systems exist. Borrowers, lenders, and investors trade current monies to finance consumption or productive enterprises and earn a return. Borrowers and lenders employ financial system rules and procedures to select which projects to fund, who invests in them, and in what economic terms.

Financial System Understanding

Like any other business, the financial system can be organized through markets, central planning, or a combination of both.

Financial markets involve borrowers, lenders, and investors negotiating loans and other transactions. Both sides exchange money in these marketplaces—cash, credit, or claims on future income or actual asset worth. They also include derivatives. Financial derivatives, like commodity futures or stock options, are based on the performance of an underlying asset. In financial markets, borrowers, lenders, and investors exchange these according to supply and demand fundamentals.

Centrally planned financial systems, such as single firms or command economies, include managers or central planners directly determining consumption and investment plans. The planner, whether a company manager or party leader, decides which initiatives get funding and who funds them.

Most financial systems combine give-and-take marketplaces and central planning. The internal financial choices of a commercial firm are centrally organized. Still, it often functions within a larger market with external lenders and investors to carry out its long-term ambitions.

The government regulates All contemporary financial markets, which limits transaction types. There are a lot of rules about economic systems because they affect tangible assets, the economy, and buyer safety.

Financial Market Parts

Different layers of the financial system have components. Financial system processes track the company’s economic activity. The economic system in a company includes accounting, revenue and spending schedules, payroll, and balance sheet verification.

Regional financial systems allow lenders and borrowers to trade funds. Regional economic systems include banks, securities exchanges, and clearinghouses.

The global financial system extends to all financial institutions, borrowers, and lenders in the global economy from a geographical perspective. Economic systems encompass the IMF, central banks, government treasuries, monetary authorities, the World Bank, and significant commercial banks globally.

Conclusion

- Financial systems are global, regional, or firm-specific organizations and practices that promote fund exchange.

- Financial systems can be market-based, centralized, or both.

- Financial institutions include banks, stock exchanges, and government treasuries.