How billionaires make their money

Have you ever wondered what makes billionaire investors so successful? From Warren Buffett to Elon Musk, these financial titans seem to have a secret formula for making money. In this article, we uncover the secrets of billionaire investors and share how you too can use their strategies to achieve financial success.

Key takeaways:

- Billionaire investors have different backgrounds and strategies, but they share common habits for success.

- Good investment habits include discipline, strategy, and avoiding common mistakes.

- Successful investors focus on long-term thinking, diversification, and understanding companies.

- Investment philosophy matters and includes value investing and growth investing.

- Common investment mistakes to avoid are impulsiveness and letting emotions drive choices.

- Avoiding mistakes requires ongoing learning and adapting to market changes.

- Secrets of billionaire investors are valuable lessons to improve your investment journey.

As humans, we have an innate desire to achieve success, whether it’s in our personal or professional lives. And when it comes to investing, who better to learn from than those who have already achieved billionaire status? But what sets these billionaire investors apart from the rest of us? What secrets do they hold that have led to their success?

In this article, we’ll explore the secrets of billionaire investors and examine their habits, strategies, investment philosophies, and common mistakes to avoid. We’ll take a closer look at some of the most famous billionaire investors, such as Warren Buffet, Ray Dalio, Carl Icahn, George Soros, and Peter Lynch, to gain insights into what has led to their success.

But more than that, we’ll delve deeper into the human side of investing, exploring the mindset and characteristics that have enabled these billionaire investors to achieve their goals. We’ll look at the importance of habits, strategies, and investment philosophy, but we’ll also examine the role of patience, risk-taking, and attention to detail in successful investing.

So if you’re ready to unlock the secrets of billionaire investors and take your investing to the next level, join us on this journey of discovery. Whether you’re a seasoned investor or just starting out, there’s something to learn from those who have already achieved success. Let’s get started.

Who are Billionaire Investors?

Billionaire investors are those who have achieved a net worth of at least one billion dollars through their investments. But who are these individuals, and what sets them apart from other investors?

Photo: Warren Buffet\ Reuters

To understand who billionaire investors are, we must first define what it means to be an investor. An investor is someone who allocates their resources, such as time and money, with the expectation of receiving a return on their investment. However, not all investors are created equal.

Billionaire investors are a unique breed of investors who have not only achieved a significant return on their investments, but have also amassed a net worth of at least one billion dollars. These individuals come from all walks of life and have made their fortunes through a variety of investment strategies.

Some billionaire investors, such as Warren Buffet, are known for their value investing strategies, where they seek out undervalued companies with strong fundamentals. Others, like Ray Dalio, are proponents of a more diversified approach, using a mix of assets to achieve their investment goals. And then there are the contrarian investors, like Carl Icahn, who look for opportunities in companies that others have written off.

What sets billionaire investors apart from other investors is their ability to not only identify these investment opportunities, but to also have the discipline to hold onto their investments for the long term. Many billionaire investors are known for their patient approach to investing, recognizing that short-term market fluctuations are often noise that can distract from the bigger picture.

Photo: Ray Dalio\ Reuters

But it’s not just their investment strategies that set billionaire investors apart. These individuals also possess a unique set of characteristics and habits that have contributed to their success. They have a passion for learning and are willing to take calculated risks. They have a keen attention to detail and are patient when it comes to seeing the fruits of their labor.

In short, billionaire investors are not just investors with a lot of money. They are individuals who possess a unique blend of discipline, patience, and focus that has enabled them to achieve their goals. By studying the habits, strategies, and investment philosophies of these individuals, we can learn valuable lessons that can help us become better investors ourselves.

Common Habits among Billionaire Investors

Billionaire investors may have vastly different investment strategies and approaches, but there are common habits that seem to be shared among many of them. These habits have contributed to their success and can provide valuable insights into what it takes to become a successful investor.

One of the most common habits among billionaire investors is their love of learning. They are constantly seeking out new knowledge and insights that can help them make better investment decisions. They read books, attend conferences, and seek out the advice of other successful investors. This thirst for knowledge has enabled them to stay ahead of the curve and make well-informed investment decisions.

Another common habit among billionaire investors is their ability to take calculated risks. They understand that investing always involves some level of risk, but they are able to assess and manage that risk in a way that allows them to capitalize on opportunities. They don’t shy away from taking bold bets, but they do so in a way that is consistent with their overall investment strategy.

Billionaire investors also have a keen attention to detail. They understand that the smallest details can have a big impact on their investments and are meticulous in their research and analysis. They are constantly reviewing financial statements, analyzing market trends, and keeping a close eye on the competition. This attention to detail allows them to make well-informed investment decisions and avoid costly mistakes.

Another habit that many billionaire investors share is their ability to think long-term. They understand that the best investments often require patience and a long-term perspective. They are not swayed by short-term market fluctuations and are willing to hold onto their investments for many years. This allows them to ride out any bumps in the road and benefit from the long-term growth of their investments.

Finally, billionaire investors have a disciplined approach to investing. They have a well-defined investment philosophy and stick to it, even in the face of market turbulence. They don’t let emotions dictate their investment decisions and are able to remain focused on their long-term goals. This discipline is what allows them to stay the course and achieve their investment objectives.

Importance of Habits for Successful Investing

When it comes to successful investing, it’s not just about making smart decisions or having a deep understanding of the markets. Rather, it’s about developing a set of habits that help you make better decisions consistently over time. And the habits of billionaire investors offer valuable insights into what it takes to achieve success in the investment world.

First and foremost, habits are important because they help us overcome our natural biases and tendencies. As humans, we are prone to making emotional decisions and being influenced by our personal biases. However, by developing good habits, we can train ourselves to make decisions based on reason and logic, rather than emotions.

For example, billionaire investors have the habit of being disciplined and focused on their long-term investment goals. They don’t get swayed by short-term market fluctuations or panic when things don’t go as planned. Instead, they remain committed to their investment philosophy and stick to their plan. This discipline and focus is crucial to achieving long-term success in investing.

Similarly, the habit of constant learning is essential to successful investing. Billionaire investors are voracious readers and lifelong learners, constantly seeking out new knowledge and insights that can help them make better decisions. By staying up to date on market trends and learning from the successes and failures of other investors, they are able to stay ahead of the curve and make better investment decisions.

Another important habit for successful investing is the ability to take calculated risks. Billionaire investors understand that risk is an inherent part of investing, but they also know how to manage that risk. They are able to assess the potential risks and rewards of an investment and make informed decisions accordingly. By taking calculated risks, they are able to capitalize on opportunities and achieve greater returns.

Attention to detail is also a crucial habit for successful investing. Billionaire investors are meticulous in their research and analysis, paying close attention to even the smallest details. They are constantly analyzing financial statements, market trends, and competitive landscapes to gain a better understanding of potential investments. By paying close attention to the details, they are able to make more informed decisions and avoid costly mistakes.

Investment Strategies of Billionaire Investors

Billionaire investors are renowned for their success in the investment world, and their strategies are studied and emulated by aspiring investors around the globe. While their specific investment strategies may vary, there are several common themes that run through their approaches to investing.

One of the most prominent investment strategies employed by billionaire investors is value investing. This strategy involves identifying undervalued stocks or companies that have strong fundamentals and holding onto them for the long-term. Billionaire investors like Warren Buffet and Charlie Munger have made a fortune using this approach, and it remains a popular strategy among successful investors today.

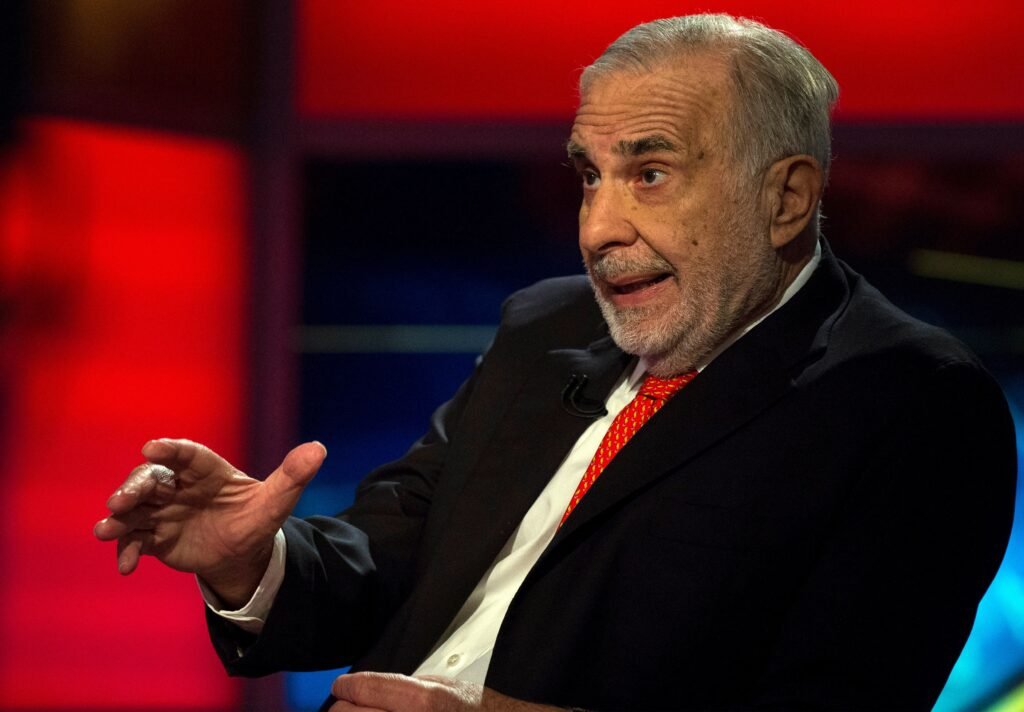

Photo: Carl Icahn\ Reuters

Another key strategy used by billionaire investors is growth investing. This strategy involves identifying companies that have strong growth potential and investing in them before they become widely recognized by the market. This approach requires a great deal of research and analysis to identify promising companies, but it can lead to significant returns if executed correctly. Billionaire investors like Peter Thiel and Jeff Bezos have employed this strategy to great effect.

In addition to these strategies, many billionaire investors also take a contrarian approach to investing. Rather than following the herd and investing in popular stocks or industries, they look for opportunities in areas that others may have overlooked. This approach requires a willingness to go against conventional wisdom and take risks, but it can lead to significant returns if successful. Billionaire investors like George Soros and Carl Icahn have made fortunes using this approach.

Another common investment strategy among billionaire investors is diversification. Rather than putting all their eggs in one basket, they spread their investments across a range of different assets and industries. This approach helps to minimize risk and ensure that they are well-positioned to take advantage of a variety of different opportunities. Billionaire investors like Ray Dalio and David Einhorn have employed this strategy to great effect.

Finally, many billionaire investors also focus on investing in disruptive technologies and industries. They look for emerging technologies or industries that have the potential to disrupt existing markets and create new opportunities for growth. Billionaire investors like Elon Musk and Mark Cuban have made fortunes by investing in disruptive technologies like electric cars and blockchain.

Investment Philosophy of Billionaire Investors

The investment philosophy of billionaire investors is something that many aspiring investors seek to emulate. But what exactly is an investment philosophy, and how do billionaire investors develop theirs?

At its core, an investment philosophy is a set of principles or beliefs that guide an investor’s decision-making process. It includes things like the investor’s approach to risk management, their beliefs about the economy and financial markets, and their views on the role of diversification and asset allocation in their portfolio.

For billionaire investors, their investment philosophy is often rooted in a deep understanding of the markets and a willingness to take calculated risks. They are often able to identify opportunities that others may have overlooked and have the conviction to act on them when the time is right.

Photo: George Soros\ Reuters

Another key aspect of the investment philosophy of billionaire investors is their focus on long-term investing. Rather than trying to make quick gains through day trading or other short-term strategies, they take a patient approach to investing and focus on building wealth over time. This requires a great deal of discipline and the ability to ignore short-term market fluctuations in favor of long-term trends and opportunities.

Billionaire investors also tend to have a high tolerance for risk, but they are not reckless. They understand that every investment carries some level of risk and take steps to manage and mitigate that risk through diversification and other strategies.

Perhaps most importantly, the investment philosophy of billionaire investors is grounded in a deep understanding of the companies and industries in which they invest. They conduct extensive research and analysis to identify companies with strong fundamentals and a sustainable competitive advantage, and they have the patience and discipline to hold onto those investments for the long-term.

In many ways, the investment philosophy of billionaire investors is a reflection of their broader worldview. They believe in the power of innovation and entrepreneurship to drive economic growth and create value for society. They see investing not just as a means to make money, but as a way to support and enable the businesses and industries that will shape the future.

Common Mistakes to Avoid While Investing

Investing can be a challenging and rewarding experience, but it’s not without its pitfalls. Even the most experienced investors can make mistakes that can lead to significant losses. So, what are some common mistakes to avoid while investing, and how can you protect yourself from them?

One of the most common mistakes investors make is letting their emotions guide their investment decisions. Fear, greed, and panic can all lead to impulsive decisions that can be detrimental to your portfolio. Successful investors understand the importance of keeping emotions in check and sticking to a well-defined investment strategy.

Another mistake to avoid is failing to diversify your portfolio. Investing all your money in a single stock or asset class can be a recipe for disaster. By spreading your investments across a range of stocks, bonds, and other assets, you can reduce your overall risk and improve your chances of long-term success.

Another common mistake is trying to time the market. No one can predict the market’s ups and downs with certainty, and attempting to do so can lead to missed opportunities and significant losses. Instead, focus on building a well-diversified portfolio that can weather market fluctuations over time.

Failing to do your due diligence is another mistake that can lead to significant losses. Before investing in any company or asset, it’s essential to do your research and understand the risks involved. This includes analyzing the company’s financial statements, management team, competitive landscape, and other key factors.

Overconfidence can also be a significant pitfall for investors. While it’s essential to have confidence in your investment decisions, overconfidence can lead to risky and ill-advised investments. Successful investors understand their limitations and seek out advice and expertise when necessary.

Finally, it’s crucial to avoid getting caught up in investment fads or following the herd. Just because everyone else is investing in a particular stock or asset doesn’t mean it’s the right choice for you. Stick to your investment strategy and make decisions based on your own research and analysis, rather than following the crowd.

Importance of avoiding mistakes for successful investing

Investing can be a tricky business, with many ups and downs along the way. Whether you are a seasoned pro or a novice, there are always risks and challenges to overcome. One of the most important factors for successful investing is avoiding common mistakes. In this section, we’ll explore why avoiding mistakes is so critical and how it can impact your investment success.

The first and most obvious reason to avoid mistakes is that they can lead to significant losses. Even a single mistake, such as investing all your money in a single stock or asset, can have disastrous consequences. Successful investors understand the importance of diversification and avoiding unnecessary risks.

Mistakes can also be costly in terms of time and opportunity. When you make a mistake, it can take time to recover your losses and get back on track. In the meantime, you may miss out on other investment opportunities or fall behind your investment goals.

Another reason to avoid mistakes is that they can undermine your confidence and motivation. When you make a mistake, it’s easy to become discouraged and lose faith in your ability to make good investment decisions. This can lead to a downward spiral of further mistakes and missed opportunities.

Perhaps the most important reason to avoid mistakes is that they can impact your long-term investment success. Successful investors understand that investing is a marathon, not a sprint. It’s essential to focus on the long-term and avoid short-term thinking that can lead to impulsive decisions and mistakes.

So, how can you avoid mistakes and improve your chances of investment success? The first step is to educate yourself about investing and the common pitfalls to avoid. This means doing your research, seeking out expert advice, and learning from your mistakes.

Another critical step is to develop a well-defined investment strategy and stick to it. This means setting clear investment goals, diversifying your portfolio, and avoiding impulsive decisions based on emotions or short-term market fluctuations.

It’s also essential to stay disciplined and avoid the temptation to chase after the latest investment fads or hot stocks. Stick to your strategy and make decisions based on sound analysis and research.

As we conclude this exploration of the secrets of billionaire investors, it’s clear that there is no one-size-fits-all approach to successful investing. However, we can draw valuable lessons and insights from the habits, strategies, and philosophy of those who have achieved great success in the world of investing.

Whether it’s Warren Buffett’s focus on value investing and long-term thinking, Ray Dalio’s emphasis on diversification and risk management, or Peter Lynch’s belief in the power of common sense and understanding of the companies you invest in, there are many different paths to success.

One thing that all successful investors have in common is a commitment to avoiding common mistakes and staying disciplined and focused on their long-term investment goals. By avoiding impulsive decisions based on emotions, staying patient and disciplined, and following a well-defined investment strategy, you can improve your chances of achieving success in the world of investing.

It’s also essential to remember that investing is a journey, not a destination. It requires ongoing learning, adaptation, and evolution as markets and economic conditions change. The key is to stay curious, open-minded, and willing to learn from both your successes and your mistakes.

So, whether you’re a seasoned investor or just getting started, remember that the secrets of billionaire investors are not magic formulas or shortcuts to success. They are simply valuable lessons and insights that can help guide your investment journey and improve your chances of achieving your long-term financial goals.

Comment Template