During the 2021 bull run, not all digital assets (cryptocurrency) have seen positive price movements.

Bitcoin (BTC) has raised the all-time high price bar several times this year, indicating that 2021 will undoubtedly be a bull market. However, not all crypto assets have fared equally well. In terms of price gains, there have been a few losers in addition to the majority of winners.

Total cryptocurrency market capitalization has increased by 190 percent since the beginning of 2021, from just under $800 million to over $2.3 trillion lately. In early November, it reached an all-time high of just over $3 trillion.

Top three cryptocurrency gainers in 2021

On January 1, 2021, the crypto top-ten in terms of market capitalization was a little different, as it included Litecoin (LTC), Chainlink (LINK), and Bitcoin Cash (BCH). By the end of the year, these had faded away, giving way to Solana (SOL), USDC, and Avalanche (AVAX).

Dogecoin is a cryptocurrency created by Dogecoin (DOGE)

Dogecoin’s value has soared this year, thanks largely to Elon Musk’s shady social media posts. DOGE was trading at $0.004 on New Year’s Day, and the majority of crypto traders were ignoring it. DOGE experienced its first small surge in February, following the first of a series of Elon pumps.

DOGE prices took a wild ride in April and May, surging more than 1,100 percent to an all-time high of $0.731 on May 8, propelling it to fourth place on the crypto market cap charts.

Starting position by market capitalization on Dec. 15: 26 — Final position: 11

In June, Musk extolled the virtues of DOGE as a payments network, causing the memecoin to experience yet another round of FOMO.

Since May, DOGE has been losing ground against Bitcoin and the US dollar. Despite all of the additional mainstream media coverage it has received, as well as major trading platform listings, the Shiba Inu-inspired joke coin has seen a massive gain of 3,800 percent so far this year. DOGE has grown 2,100 percent year-over-year, from 168 satoshis to 3,696 satoshis in mid-December.

Solana is a character in the film Solana (SOL)

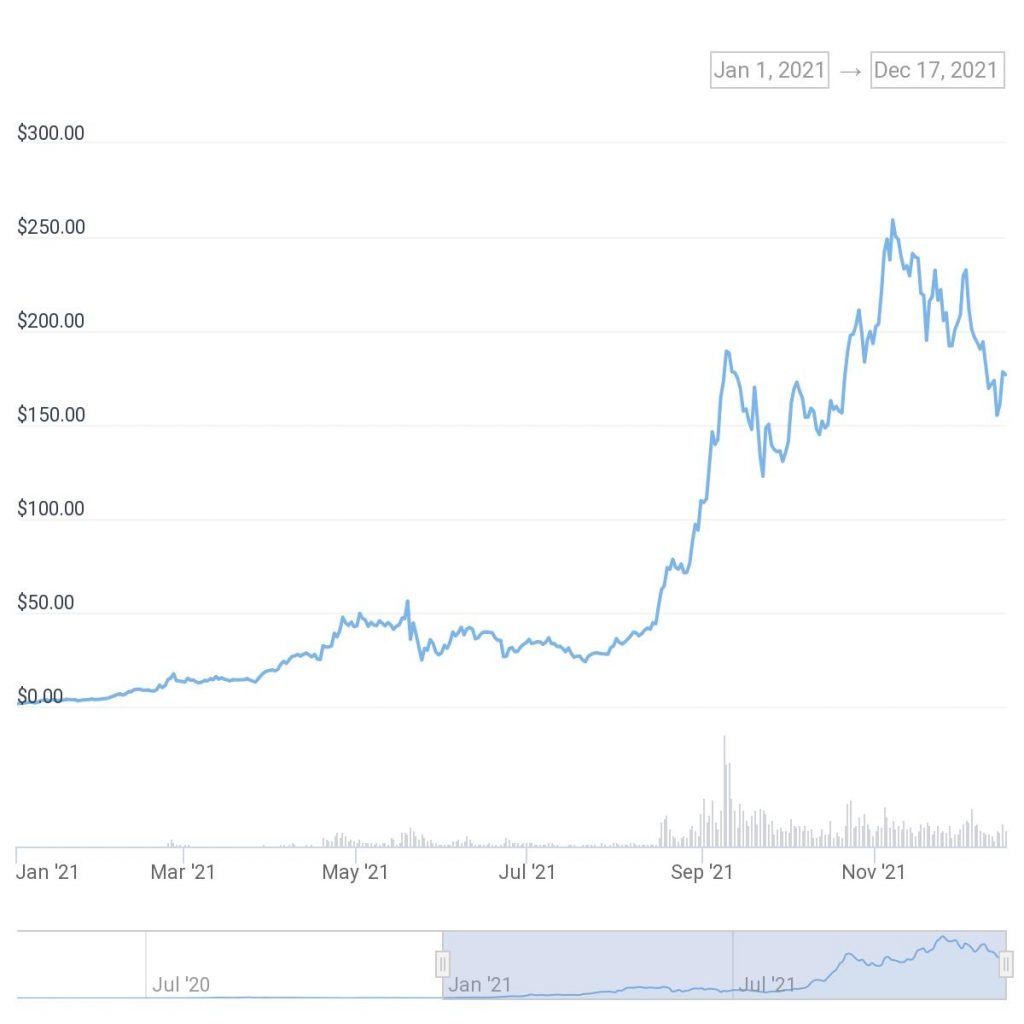

Solana, the enterprise blockchain’s native token, has also had a good year in terms of gains. SOL was trading for a little over $150 at the time of writing, down from $1.52 at the start of 2021. This is a staggering increase of more than 9,800% in less than a year.

SOL reached an all-time high of $260 in early November but has since fallen as markets have begun to correct late in the year. SOL has climbed to fifth place in the market cap charts after peaking at fourth. SOL has gained 6,473 percent against BTC in the last year.

Starting position: 112 — Final position: 5

Solana has gained traction as a result of major investments and increased adoption following the rise in transaction prices on Ethereum, which has been dubbed an “Ethereum killer.” Solana Labs raised $314 million in June from Andreessen Horowitz and Polychain Capital through a private token sale.

Read more on: Will Solana Outperform Bitcoin and Ethereum in 2022?

Terra is a character in the game Terra (LUNA)

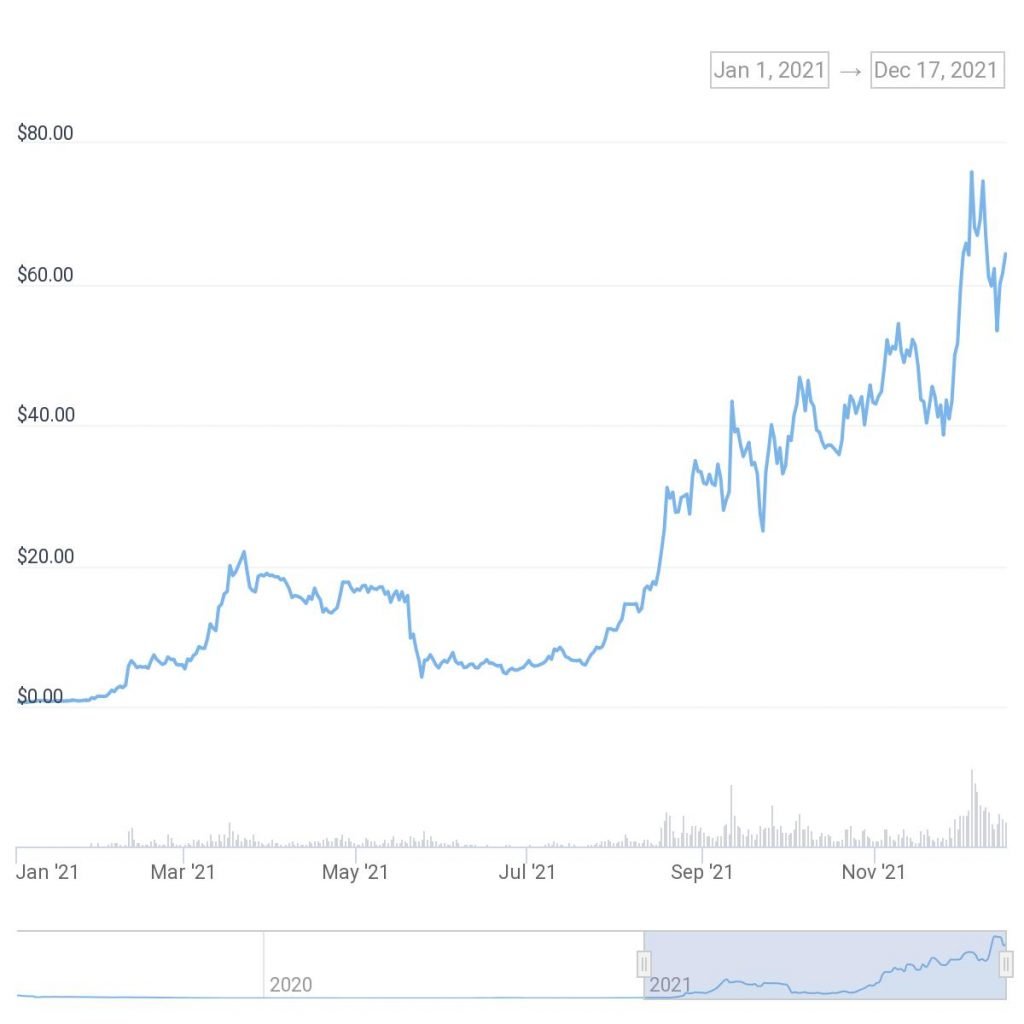

Terra’s native token made a brief appearance in the top ten cryptocurrency rankings. LUNA began the year with a market cap of $0.65 and was largely unknown to retail investors.

Prices were raised in March and May, but they didn’t really take off until August, when LUNA hit an all-time high of $77.73 on December 5. LUNA had increased by 8,515 percent since the beginning of the year at the time of writing. LUNA has increased 5,815 percent against BTC in satoshi terms this year.

The bullish price action is largely due to the rapid expansion of partners on the Terra ecosystem.

Starting position (CMC): 62 — Final position (CMC): 10

Avalanche’s AVAX has increased by 2,330 percent this year, Polygon’s MATIC has increased by more than 12,000 percent, and Binance Coin (BNB) has increased by 1,271 percent this year.

In 2021, the top three crypto losers will be

Computer connected to the internet (ICP)

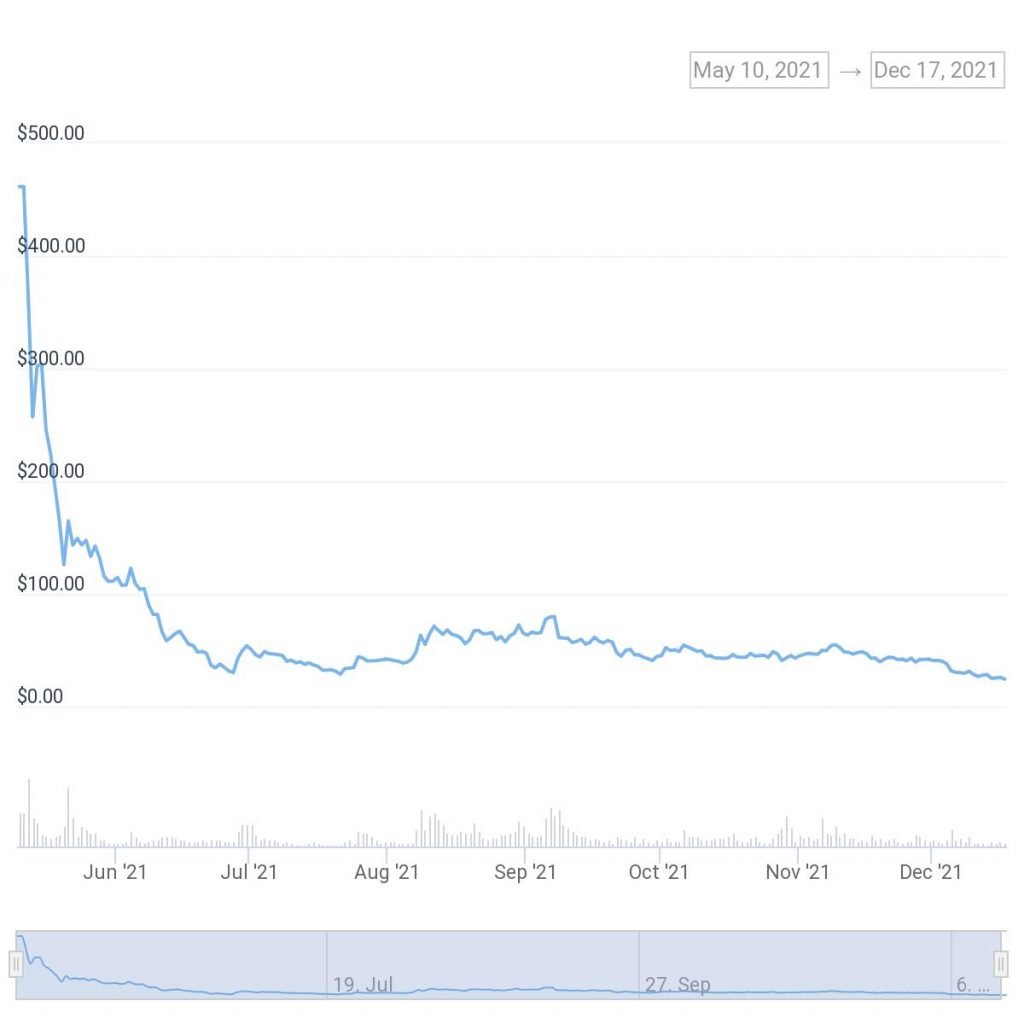

After 5 years of largely secretive development, Dfinity’s Internet Computer project exploded onto the scene this year amid a world of hype. It promised an internet revolution, allowing developers to install their code directly on a “public internet” without having to rely on third-party hosting companies, thereby displacing the trillion-dollar legacy internet and IT industry.

When ICP tokens were listed on major exchanges in mid-May, speculators in a frenzy for the next big thing in crypto loaded upon them, sending prices skyrocketing to a very quick all-time high of $700 on May 10.

Starting/Highest position: 8 — Final position: 37

ICP prices have nearly collapsed since then, sinking to an all-time low of $24.29 on December 4, a painful 96 percent drop from their peak just seven months prior. In terms of satoshis, it has also lost 93 percent against Bitcoin.

EOS is an acronym for “electronic (EOS)

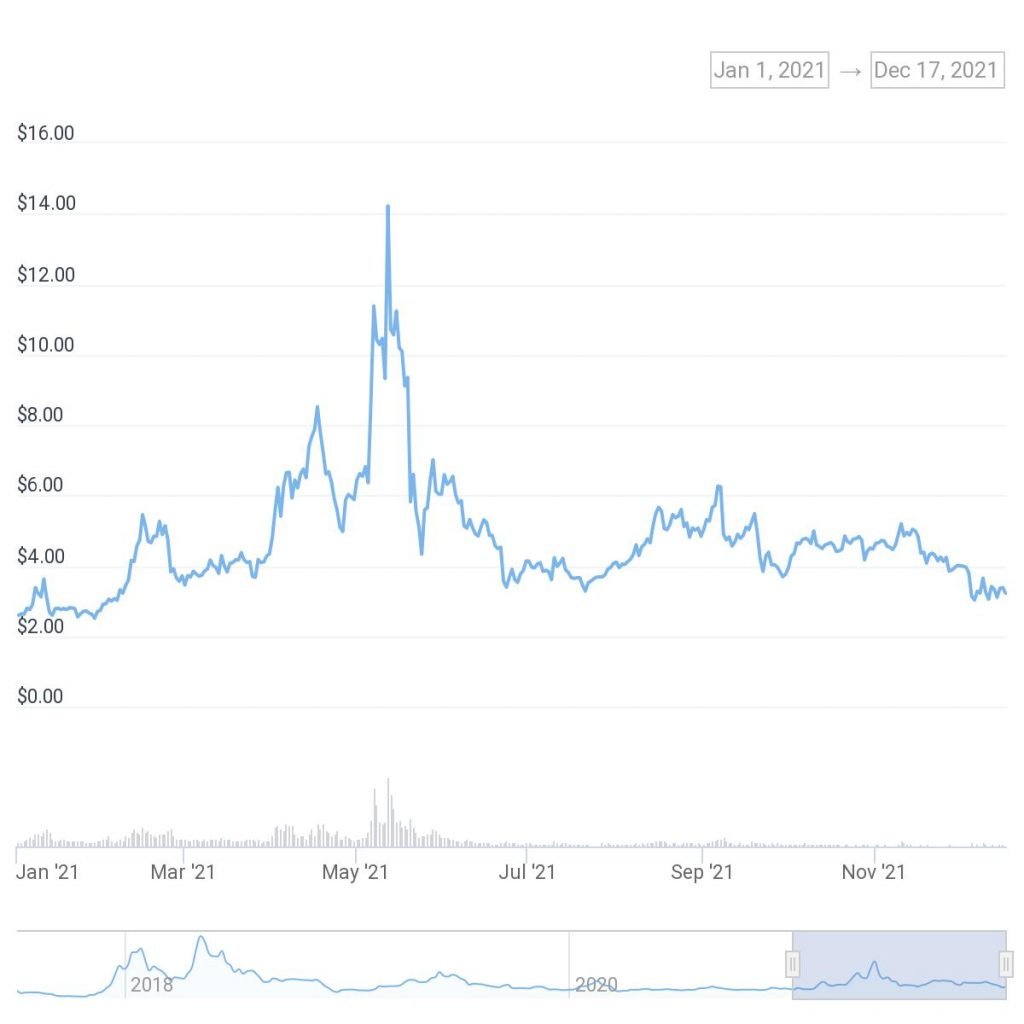

While those around it have soared, the once darling of crypto that many predicted would kill Ethereum has done very little in terms of price movements this year.

On January 1, EOS had already dropped out of the top ten by market capitalization, and it continued to fall down the rankings throughout the year. In the grand scheme of things, EOS prices have only increased by 15% over the year while others have increased by three and four figures, so we would consider it a loser.

At the time of writing, Block. one’s once-hyped token was trading at $3.25, having fallen to 50th place by market cap. It is currently down 86% from its all-time high of $22.71 in April 2018 and has lost 22% against BTC this year.

Members of the EOS ecosystem expressed their displeasure with the network’s direction in early November.

Starting position: 15 — Final position: 50

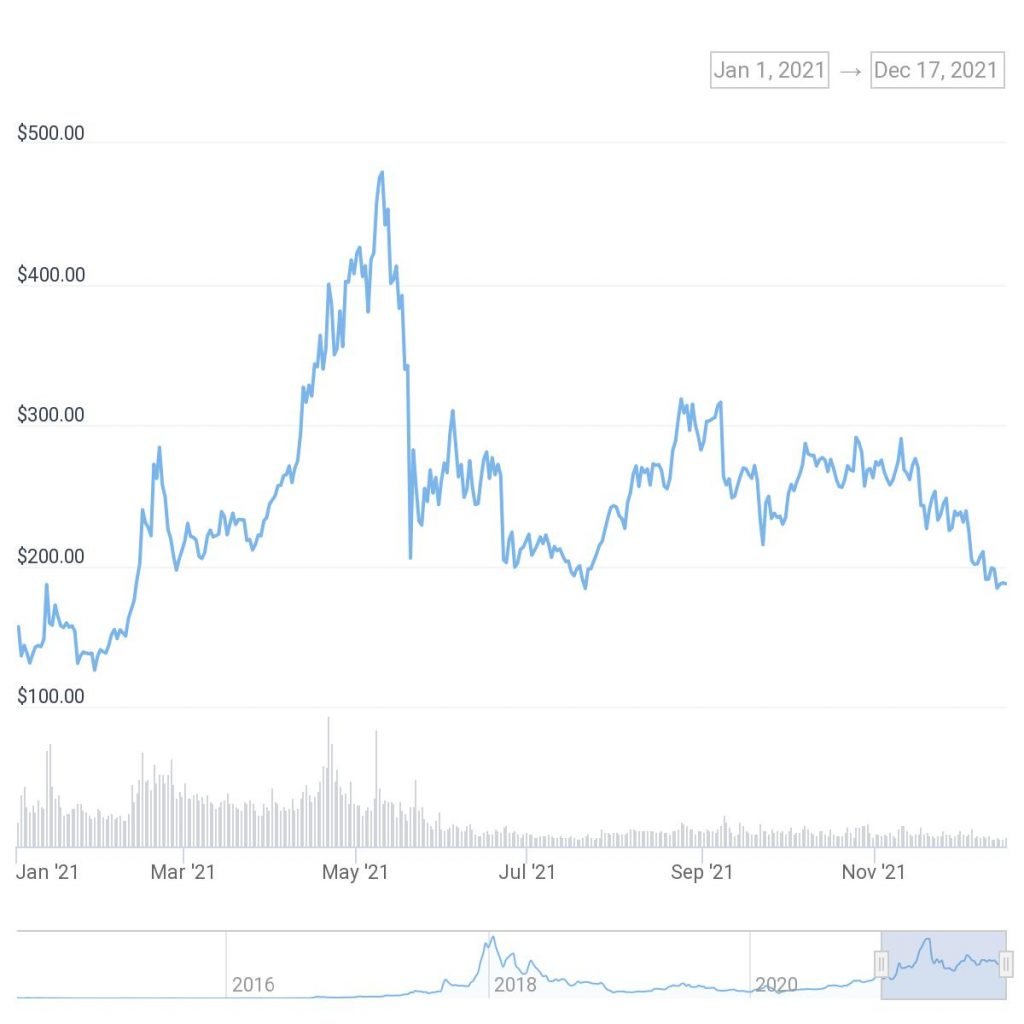

Monero is a cryptocurrency (XMR)

Monero, a privacy-focused cryptocurrency, has also dropped significantly in market capitalization this year, as a number of major exchanges have delisted digital assets that provide anonymity.

XMR prices have only risen by 17 percent this year, and are still well below their all-time high of $524 set in January 2018. XMR is currently trading at around $183, down 66 percent from its peak, and has dropped to 49th in the coin cap tables. Since the beginning of the year, Monero has lost 30% of its value against Bitcoin.

Starting position: 16 — Final position: 49

To put these gains and losses into context, Bitcoin has gained 67.5 percent year to date (YTD), while Ethereum has gained 440 percent.

Comment Template