UNI, AAVE, CRV, AXS, and DOGE are just a few of the top cryptocurrency projects in 2021 that have shaped the cryptocurrency ecosystem and paved the way for mass adoption.

In many ways, 2021 was a watershed year for the cryptocurrency market, and most investors are ecstatic that Bitcoin (BTC) reached a new all-time high of $68,789. In the same timeframe, Ether (ETH) experienced a parabolic rally, with its price rising 565 percent from January 1 to $4,859 on November 10.

While large-cap cryptocurrencies had a banner year, the altcoin market saw some of the most significant gains and developments, with decentralized finance (DeFi) and nonfungible tokens (NFTs) rallying by thousands of percent and helping to usher in a new level of awareness and adoption for blockchain technology and cryptocurrencies.

Here are five altcoin projects that contributed significantly to the cryptocurrency ecosystem in 2021.

Uniswap

Since its launch in the summer of 2020, the decentralized exchange Uniswap (UNI) has arguably had the greatest impact on the crypto ecosystem as a whole, with the DEX seeing significant growth throughout 2021 as it helped thousands of new crypto projects launch by removing the barriers to launch that existed on centralized exchanges.

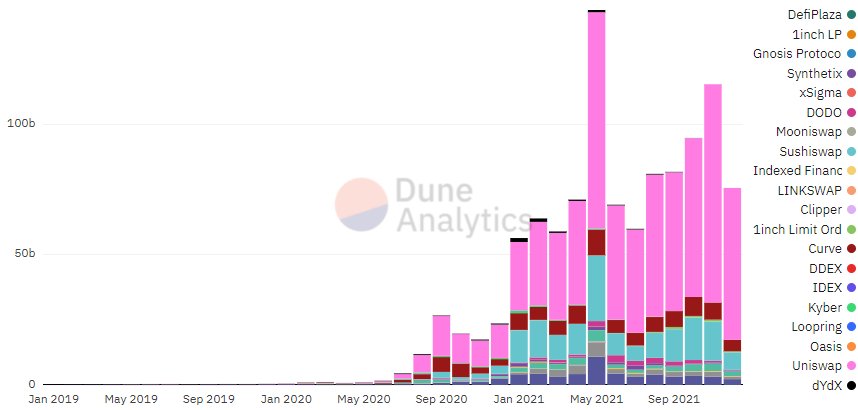

According to data provided by Dune Analytics, Uniswap has been the most popular DEX throughout the year, with more trading volume than all other DEXs combined.

The volume traded on decentralized exchanges really started to ramp up in the second half of 2021, led in large part by activity on Uniswap, as shown in the graph above.

Uniswap also led the field in development in 2021, with the protocol’s developers announcing the release of Uniswap v3 in March. Multiple protocol upgrades were included in the v3 upgrade, and it laid the groundwork for layer-two scaling solutions like Optimism and Arbitrum to be integrated with Uniswap in order to help users reduce transaction costs and processing times.

Aave

Aave (AAVE) is a decentralized lending protocol that allows users to deposit their tokens and either lend them out for a profit or pledge them as collateral to borrow another asset.

As the DeFi sector grew in popularity in early 2021, AAVE became a community favorite due to the wide range of crypto assets it supported and the support of some well-funded players.

AAVE’s capabilities and reach grew this year with the release of AAVE v2, which included support for Polygon, a layer-two scaling solution, and Avalanche, a popular cross-chain blockchain network.

The total liquidity available on the AAVE protocol has surpassed $25.7 billion as a result of these new capabilities, making it the top-ranked DeFi protocol by total value locked (TVL).

Curve

Curve Finance is a stablecoin-focused protocol that manages liquidity on the platform and across the DeFi ecosystem with the help of an automated market maker.

Stablecoins, which provide sufficient liquidity for the market and a safe haven for traders seeking shelter during periods of high volatility, have emerged as a foundational piece for the cryptocurrency community as a whole in 2021.

Curve protocol and its native CRV have benefited from the growing importance of stablecoins by hastening the integration of stablecoins into many of the top DeFi protocols, including the Yearn. Finance ecosystem and Convex Finance.

Despite the fact that stablecoins account for a large portion of the assets locked on the Curve protocol, the platform now ranks second in terms of TVL behind AAVE, with $21.77 billion in value locked in Curve vaults, according to data from Defi Llama.

Curve has also integrated with many of the most active blockchain networks, including Ethereum, Avalanche, Harmony, xDAI, Polygon, Arbitrum, and Fantom, demonstrating the protocol’s goal of becoming the global stablecoin liquidity provider.

Read more on: 2021’s top cryptocurrency winners and losers

Axie

Axie Infinity is a play-to-earn (p2e) trading and battling game in which players can collect, breed, raise, battle, and trade Axies, which are NFT-based creatures.

Over the course of 2021, the p2e model became a new fan favorite because it allows users to earn a daily income while playing their favorite games, which has a few distinct advantages over the traditional pay-to-play model.

With the rise in popularity of Axie Infinity, the platform’s native AXS token reached a new all-time high. At its peak on August 6, the platform generated $17.55 million in daily revenue as the token soared to new heights.

Axie Infinity was also one of the first projects to establish the trend of moving away from the Ethereum network due to high transaction fees and slowness. Earlier this year, the project switched to the Ronin sidechain, and in November, it launched Katana, its own DEX.

Dogecoin

Dogecoin is an open-source proof-of-work cryptocurrency that has dominated the “meme” coin market since its inception in 2021.

While the project has made few technological or development contributions, frequent shilling from figures such as Tesla CEO Elon Musk and Shark Tank star Mark Cuban helped to propel Doge to a 23,746 percent rally, with the price rising from $0.0031 on January 1 to $0.74 on May 8.

The Dogecoin movement also sparked a meme-coin rally and spawned a slew of copy-dog projects, including Shiba Inu (SHIB) and Dogelon Mars, on top of the price gains (ELON).

Comment Template